News & Analysis

Critique of the Alternative Dispute Resolution (ADR) of Tax Disputes in Kenya

News & Analysis

Brief Overview of Kenyan Bankruptcy Law

Kiragu Wathuta & Company Advocates was established in 2013 by Mr. Kiragu Wathuta, an Advocate of the High Court of Kenya called to the bar in the year 2009. Our firm is run by an organized team of proffessionals who are highly skilled and widely exposed to diverse areas of law and the industry in general.

We have built a name for PROFESSIONALISM AND EXPERTISE in various disciplines of legal services including but not limited to civil and commercial litigation, conveyance and property matters as well as commercial and corporate law practice.

We provide value-added service in consonance with each individual client’s needs. For our clients, their interests are paramount and the client is our number one priority.

Our Portfolio of Clients is drawn from Property Owners, Developers, Investors and Joint Ventures, Corporate Entities, Financial institutions, Parastatals, Manufacturing Companies, Mortgage Institutions as well as individuals. We continue to endear our services to reach beyond our borders.

News & Analysis

What is Carbon Markets?

As one of the top law firms in Nairobi, MMA Advocates is renowned for its proactive strategy and innovative legal lawyer advice. Our firm is committed to delivering strategic assistance that not only tackles current difficulties but also equips clients for future legal trends and advancements. As top lawyers in Nairobi Kenya, we take great satisfaction in our ability to combine in-depth legal knowledge with creative problem-solving. We keep a close eye on business trends and legal advancements to deliver timely guidance that enables our clients to make wise choices.

Our main goal as MMA Advocates is to establish long-lasting partnerships based on integrity, decency, and reliability. Since every client’s circumstance is unique, our best advocates in Kenya offer timely service and individualized attention at every stage of our collaboration. We make sure our clients are informed and empowered throughout their legal journey because we value openness and transparency in communication. In every case we take on, we are deeply committed to obtaining positive results and client satisfaction. This is just one aspect of our unwavering commitment to quality.

Whether you are a startup negotiating regulatory obstacles, an established corporation expanding, or a private citizen seeking legal assistance on personal problems, our Best Corporate Lawyers in Kenya are dedicated to becoming your legal partner. Our expertise include Commercial Litigation, Real Estate & Development, Fintech, Public Procurement (Public Private Partnerships), Project Finance, Public Law Litigation, Legal Audits & Compliance Advisory and Crisis Management.

We hope to arm you with the legal know-how and strategies needed to achieve your objectives. Our team enjoys taking on challenging legal matters with creativity and strategic understanding, protecting your rights and effectively achieving your goals. With a thorough comprehension of both regional laws and global norms, we are prepared to confidently and competently lead you through the complexities of corporate law.

In the intensely competitive legal arena, our tailored legal and strategic solutions distinguish us. We value depth over breadth, guaranteeing our clients our full dedication and unparalleled efficiency. Where many spread themselves wide, we narrow our focus to a select few of the most challenging cases. We tread the path less traveled.

To find out more about how MMA Advocates in Nairobi Kenya can help you with your legal issues, get in touch with us. With our team of committed professionals and our standing as one of the top law firms in Nairobi, we are well-positioned to offer outcomes that surpass expectations and guarantee your success in a legal environment that is always changing.

News & Analysis

Review: Alternative Dispute Resolution (ADR) Journal, Volume 12(3), 2024

Kariuki Muigua & Company Advocates is a Top-Tier Kenyan law firm situated at the heart of Nairobi city in Kenya. We are a broad-based practice with a reputation for offering a full range of quality services to our domestic and international clients.

At KM&CO, we take pride in offering personalized attention to our diverse clientele. Our practice aspires to offer efficient and cost-effective legal solutions that meet our esteemed clients’ needs in a timely and competent manner.

KM&CO was founded in 1993 by the current senior Advocate, Dr. Kariuki Muigua. It is based in the Central Business District of Nairobi at the Pioneer Assurance House located opposite 7th August Bomb Blast Memorial Park enjoying the convenience of close proximity to major financial, commercial and governmental institutions.

We are open for consultations with our clients worldwide; we have lawyers on standby for 24 hours to cover diverse time zones that impact on our global clients.

-

Lawyers2 years ago

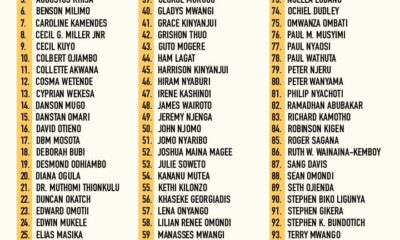

Lawyers2 years agoTHE LAWYER AFRICA Litigation Hall of Fame | Kenya in 2023

-

News & Analysis3 years ago

News & Analysis3 years agoThe Definition and Scope of Biodiversity

-

News & Analysis3 years ago

News & Analysis3 years agoThe Definition, Aspects and Theories of Development

-

Lawyers2 years ago

Lawyers2 years agoTHE LAWYER AFRICA Top 100 Litigation Lawyers in Kenya 2023

-

News & Analysis3 years ago

News & Analysis3 years agoTHE TOP 200 ARBITRATORS IN KENYA 2022

-

News & Analysis1 year ago

News & Analysis1 year agoThe Role of NEMA in Pollution Control in Kenya

-

News & Analysis3 years ago

News & Analysis3 years agoRole of Science and Technology in Environmental Management in Kenya

-

News & Analysis1 year ago

News & Analysis1 year agoHow to Become an Arbitrator in Kenya