News & Analysis

Basics of Situation Analysis and Stakeholder Engagement in ESG Reporting

Published

2 years agoon

By

Admin

By Dr. Kariuki Muigua, PhD (Leading Environmental Law Scholar, Policy Advisor, Natural Resources Lawyer and Dispute Resolution Expert from Kenya), Winner of Kenya’s ADR Practitioner of the Year 2021, ADR Publication of the Year 2021 and CIArb (Kenya) Lifetime Achievement Award 2021*

The ESG Manual defines situational analysis as a process by which an organisation’s internal and external environment is analyzed in order to evaluate its current and potential capabilities to build stakeholder value. In the ESG reporting context, a situational analysis is performed to achieve an understanding of the organisation’s strategy, an understanding of the organisation’s internal and external stakeholders and their respective needs or expectations of the organization and an assessment of the value that ESG integration brings (potentially) to the organisation. The ESG reporting team should work with the organisational strategy team to understand the key strategic priorities of the business. The team is also expected to obtain a good enough understanding of the financial ambition, key products and markets and the business and the operating model of the listed company.

As a matter of fact, ESG reports target a very wide set of stakeholders compared to financial reporting. Thus stakeholder analysis, prioritization and engagement critical in ESG reporting to ensure that the ESG reports meets the needs of these diverse sets of stakeholders. Here, the term “stakeholders” is used to refer to all entities or individuals “that can reasonably be expected to be significantly affected by the reporting organisation’s activities, products and services, or whose actions can reasonably be expected to affect the ability of the organisation to successfully implement its strategies and achieve its objectives.” According to the ESG Manual, stakeholders are not only investors and regulators, but also include “those who are invested in the organization (such as employees and shareholders), as well as those who have other relationships to the organisation (such as other workers who are not employees, suppliers, vulnerable groups, local communities, and NGOs or other civil society organisations, among others).”

The assessment of stakeholder needs is a very critical step in ESG reporting and the ESG Manual recommends that the respective organization consider several factors in assessing stakeholders. The first factor to consider is the economic influence of the respective stakeholder. This is the ability of the stakeholders to influence the ability to perform economic activities through financial capital and through operating permits and licenses. Examples of stakeholders who wield economic influence include shareholders, investors, regulators, and joint venture partners. The second critical factor in assessment of stakeholders is social influence. The ESG Manual defines this as “the ability to influence the ability to acquire a social license to operate.” The key examples of organizations stakeholders who have social influence include politicians, local NGOs and community groups.

The environmental impact of the activities of the organization is also a key determinant of the relevant stakeholder. In this regard, stakeholders are identified based on those who rely on or are interested in the same natural resources exploited by the organisation and the organisation’s environmental impacts. These could include indigenous communities, county administration and the neighbourhood of the organization’s operation. Fiduciary responsibility is also key in assessment of stakeholders and refers to legal, financial and operational responsibilities the organisation has to stakeholders such as financiers, regulators, suppliers and customers. In addition, proximity stakeholders are those persons and entities that are directly affected by the day to day running of the organisation. They include employees, customers, suppliers and local communities. There are also stakeholders who are identifiable by their dependence in that they rely on the organization and its activities for their economic and social wellbeing. These include employees and suppliers along with their dependents and local communities.

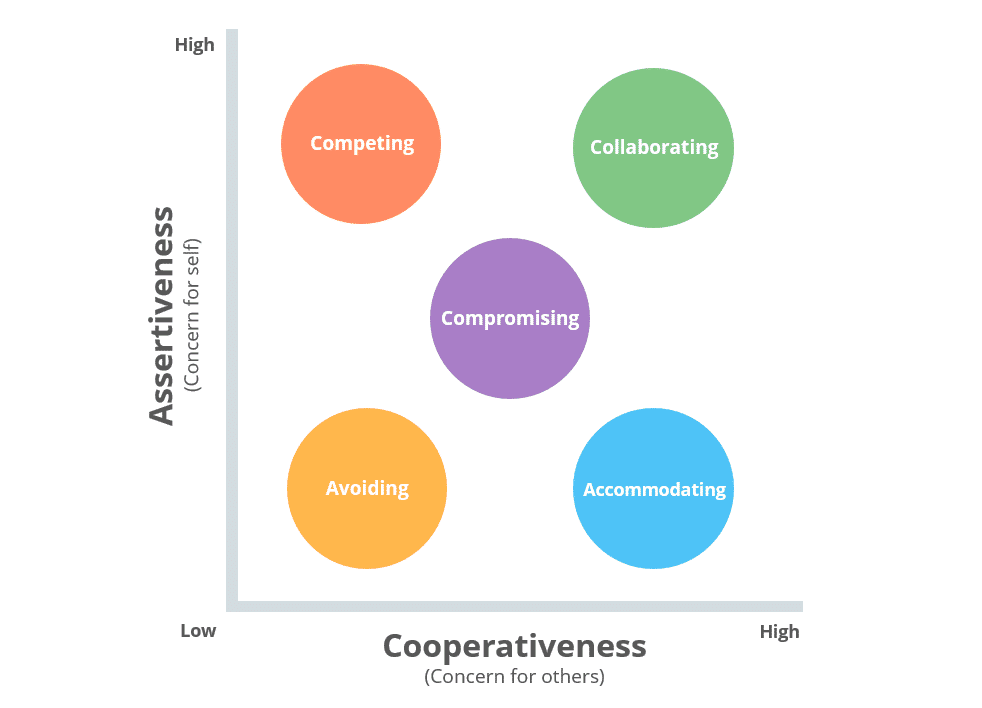

In ESG reporting process, stakeholder engagement is critical in determining materiality of ESG topics for disclosure. However, different stakeholders have different kinds and levels of needs and the ESG Manual recommends the prioritizing of stakeholders according to their level of influence and expectations from the organisation. The Manual proposes that the ESG team use a stakeholder prioritization matrix to assess the importance of an organisation’s ESG impacts to the decision-making activities of these stakeholders. Where the respective stakeholder falls within the matrix depends on their level of interest in the organization and ability to exert influence. Stakeholders are classified in four categories, namely high influence but low stakes stakeholders, high influence and high stakes stakeholders, low influence and low stakes stakeholders and low influence but high stakes stakeholders.

Low influence and low stakes stakeholders include researchers, media and suppliers who the organization need to monitor regularly. Stakeholder engagement for low influence and low stakes stakeholders include actively influencing positive perception through media channels, publicly acknowledging the organisation’s interest in their views by soliciting comments on ESG performance, inviting them to launch of the ESG report and review analysis of their position regularly. Low influence but high stakes stakeholders need to be engaged routinely and examples include customers, civil society and media. Their engagement strategy should include providing regular updates on ESG performance, regularly soliciting views on the organisation’s performance with regards to ESG issues, ensuring communication is targeted to their specific needs and expectations on the organisation and managing emerging issues immediately.

On the other hand, examples of high influence but low stakes stakeholders include retail investors, social media and lenders who need to be engage routinely. The ESG Manual enumerates the engagement strategies for high influence but low stakes stakeholders as including soliciting their focused involvement and input regularly, involving them in key decision points, actively soliciting views on the organisation’s performance with regards to ESG issues, managing emerging issues immediately and reviewing analysis of their position regularly. Lastly, high influence and high stakes stakeholders include regulators, investors and employees who require regular communication from the organization. According to the ESG Manual, engagement strategies for high influence and high stakes stakeholders including incorporating them as part of the governance structure in the organisation, communicating ESG impacts frequently to them, actively soliciting their views on the organisation’s performance with regards to ESG issues and manage emerging issues touching on them immediately.

The sample outline framework for an ESG Report provided under the ESG Manual under Annex 1 recommends that the Message from the Board Chair should contain “how stakeholder expectations are identified and the framework that exists to ensure that these are addressed.” In addition, stakeholder engagement is recommended to form a key part of the ESG report. As part of the Stakeholder engagement, the ESG Manual recommends outlining the approach to identifying and prioritizing stakeholders and the stakeholder engagement strategies for the identified and prioritised stakeholders relevant to the ESG issues of the Organization.

*This article is part of an ongoing series on ESG (Environmental, Social and Governance) in Kenya by Dr. Kariuki Muigua, PhD, Kenya’s ADR Practitioner of the Year 2021 (Nairobi Legal Awards), ADR Publisher of the Year 2021 and ADR Lifetime Achievement Award 2021 (CIArb Kenya). Dr. Kariuki Muigua is a foremost Environmental Law and Natural Resources Lawyer and Scholar, Sustainable Development Advocate and Conflict Management Expert in Kenya. Dr. Kariuki Muigua is a Senior Lecturer of Environmental Law and Dispute resolution at the University of Nairobi School of Law and The Center for Advanced Studies in Environmental Law and Policy (CASELAP). He has published numerous books and articles on Environmental Law, Environmental Justice Conflict Management, Alternative Dispute Resolution and Sustainable Development. Dr. Muigua is also a Chartered Arbitrator, an Accredited Mediator, the Africa Trustee of the Chartered Institute of Arbitrators and the Managing Partner of Kariuki Muigua & Co. Advocates. Dr. Muigua is recognized as one of the leading lawyers and dispute resolution experts by the Chambers Global Guide 2022.

References

NSE, “ESG Disclosures Guidance Manual,” November 2021, p. 13-15; Available at: https://sseinitiative.org/wp-content/uploads/2021/12/NSE-ESG-Disclosures-Guidance.pdf(accessed on 04/06/2022).

You may like

-

The Challenges in Actualizing Sustainable Blue Economy in Kenya

-

The Meaning of Blue Economy in Kenyan Context

-

The Meaning of Environmental Pollution in Kenya

-

Overview of Human Right to Clean, Safe and Healthy Environment

-

What Issues are Required for ESG Reporting in Kenya?

-

Value Creation as an ESG Management Strategy

News & Analysis

Way Forward in Applying Collaborative Approaches Towards Conflict Management

Published

4 weeks agoon

March 24, 2024By

Admin

By Hon. Prof. Kariuki Muigua, OGW, PhD, C.Arb, FCIArb is a Professor of Environmental Law and Dispute Resolution at the University of Nairobi, Member of Permanent Court of Arbitration, Leading Environmental Law Scholar, Respected Sustainable Development Policy Advisor, Top Natural Resources Lawyer, Highly-Regarded Dispute Resolution Expert and Awardee of the Order of Grand Warrior (OGW) of Kenya by H.E. the President of Republic of Kenya. He is the Academic Champion of ADR 2024, the African ADR Practitioner of the Year 2022, the African Arbitrator of the Year 2022, ADR Practitioner of the Year in Kenya 2021, CIArb (Kenya) Lifetime Achievement Award 2021 and ADR Publisher of the Year 2021 and Author of the Kenya’s First ESG Book: Embracing Environmental Social and Governance (ESG) tenets for Sustainable Development” (Glenwood, Nairobi, July 2023) and Kenya’s First Two Climate Change Law Book: Combating Climate Change for Sustainability (Glenwood, Nairobi, October 2023), Achieving Climate Justice for Development (Glenwood, Nairobi, October 2023), Promoting Rule of Law for Sustainable Development (Glenwood, Nairobi, January 2024) and Actualizing the Right to a Clean and Healthy Environment (Glenwood, Nairobi, March 2024)*

It is necessary to embrace and utilize collaborative approaches in managing conflicts. These techniques include mediation, negotiation, and facilitation. These mechanisms are effective in managing conflicts since they encourage parties to embrace and address disagreements through empathy and listening towards mutually beneficial solutions. Collaborative approaches also have the potential to preserve relationships, build trust, and promote long term positive change. They also ensure a win-win solution is found so that everyone is satisfied which creates the condition for peace and sustainability. These approaches are therefore ideal in managing conflicts. It is therefore important to embrace collaborative approaches in order to ensure effective management of conflicts.

In addition, it is necessary for third parties including mediators and facilitators to develop their skills and techniques in order to enhance the effectiveness of collaborative approaches towards conflict management. For example, it has correctly been observed that mediators and facilitators should listen actively and empathetically in order to assist parties to collaborate towards managing their dispute. Therefore, when a dispute arises, the first step should involve listening to all parties involved with an open mind and without judgment. This should entail active listening, which means paying attention to both verbal and nonverbal cues and acknowledging the emotions and perceptions involved.

It has been observed that by listening empathetically, a third party such as a mediator of facilitator can understand each person’s perspective and start to build a foundation for resolving the conflict through collaboration. In addition, while collaborating towards conflict management, it is necessary to encourage and help parties to focus on interests and not positions. It has been pointed out that focusing positions can result in a standstill which can delay or even defeat the conflict management process. However, by identifying and addressing the underlying interests parties can find common ground and collaborate towards coming up with creative solutions towards their conflict.

Mediators and facilitators should also assist parties to look for areas of agreement or shared goals. Identifying a common ground can build momentum and create a positive environment for resolving the conflict. Further, in order to ensure the effectiveness of collaborative approaches in conflict management, it is necessary to build strong collaboration. It has been asserted that strong collaboration can be achieved by establishing a shared purpose, cultivating trust among parties, encouraging active participation by all parties, and promoting effective communication.

Strong collaboration enables parties to develop trust between and among themselves and strengthen communication channels between the various parties. It also helps to generate inclusive solutions that arise from wider stakeholders’ views. Therefore while applying collaborative approaches, it is necessary for parties to foster strong collaboration by identifying common goals, building trust, ensuring that all stakeholders are involved, and communicating effectively in order to come up with win-win outcomes.

Finally, while embracing collaborative approaches in conflict management, it is necessary for parties to consider seeking help from third parties if need arises. For example, negotiation is always the first point of call whenever a conflict arises whereby parties attempt to manage their conflict without the involvement of third parties. It has been described as the most effective collaborative approach towards conflict management since it starts with an understanding by both parties that they must search for solutions that satisfy everyone.

It enables parties to a dispute to come together to openly discuss the issue causing tension, actively listen to each other, and come up with mutually satisfactory solutions. However, it has been correctly observed that negotiation may fail especially if the conflict is particularly complex or involves multiple parties due to challenges in collaborating. In such circumstances, where negotiation fails, parties should consider resorting to other collaborative approaches such as mediation and facilitation where they attempt to manage the conflict with the help of a third party. A mediator or facilitator can assist parties to collaborate and continue with the negotiations and ultimately break the deadlock.

*This is an extract from Kenya’s First Clean and Healthy Environment Book: Actualizing the Right to a Clean and Healthy Environment (Glenwood, Nairobi, January 2024) by Hon. Prof. Kariuki Muigua, OGW, PhD, Professor of Environmental Law and Dispute Resolution, Senior Advocate of Kenya, Chartered Arbitrator, Kenya’s ADR Practitioner of the Year 2021 (Nairobi Legal Awards), ADR Lifetime Achievement Award 2021 (CIArb Kenya), African Arbitrator of the Year 2022, Africa ADR Practitioner of the Year 2022, Member of National Environment Tribunal (NET) Emeritus (2017 to 2023) and Member of Permanent Court of Arbitration nominated by Republic of Kenya and Academic Champion of ADR 2024. Prof. Kariuki Muigua is a foremost Environmental Law and Natural Resources Lawyer and Scholar, Sustainable Development Advocate and Conflict Management Expert in Kenya. Prof. Kariuki Muigua teaches Environmental Law and Dispute resolution at the University of Nairobi School of Law, The Center for Advanced Studies in Environmental Law and Policy (CASELAP) and Wangari Maathai Institute for Peace and Environmental Studies. He has published numerous books and articles on Environmental Law, Environmental Justice Conflict Management, Alternative Dispute Resolution and Sustainable Development. Prof. Muigua is also a Chartered Arbitrator, an Accredited Mediator, the Managing Partner of Kariuki Muigua & Co. Advocates and Africa Trustee Emeritus of the Chartered Institute of Arbitrators 2019-2022. Prof. Muigua is a 2023 recipient of President of the Republic of Kenya Order of Grand Warrior (OGW) Award for his service to the Nation as a Distinguished Expert, Academic and Scholar in Dispute Resolution and recognized among the top 5 leading lawyers and dispute resolution experts in Band 1 in Kenya by the Chambers Global Guide 2024 and was listed in the Inaugural THE LAWYER AFRICA Litigation Hall of Fame 2023 as one of the Top 50 Most Distinguished Litigation Lawyers in Kenya and the Top Arbitrator in Kenya in 2023.

References

Bercovitch. J., ‘Conflict and Conflict Management in Organizations: A Framework for Analysis.’ Available at https://ocd.lcwu.edu.pk/cfiles/International%20Relations/EC/IR403/Conflict.ConflictManagementinOrga nizations.pdf (Accessed on 01/03/2024).

Bercovitch. J., ‘Mediation Success or Failure: A Search for the Elusive Criteria.’ Cardozo Journal of Conflict Resolution, Vol. 7, p 289.

Bloomfield. D., ‘Towards Complementarity in Conflict Management: Resolution and Settlement in Northern Ireland,’ Journal of Peace Research., Volume 32, Issue 2.

Burrell. B., ‘The Five Conflict Styles’ Available at https://web.mit.edu/collaboration/mainsite/ modules/module1/1.11.5.html (Accessed on 01/03/2024).

Demmers. J., ‘Theories of Violent Conflict: An Introduction’ (Routledge, New York, 2012).

Diana. M., ‘From Conflict to Collaboration’ Available at https://www.pmi.org/learning/library/conflict-collaboration-beyond-projectsuccess-1899 (Accessed on 01/03/2024).

Food and Agriculture Organization., ‘Collaborative Conflict Management for Enhanced National Forest Programmes (NFPs)’ Available at https://www.fao.org/3/i2604e/i2604e00.pdf (Accessed on 01/03/2024).

International Organization for Peace Building., ‘Natural Resources and Conflict: A Path to Mediation.’ Available at https://www.interpeace.org/2015/11/naturalresources-and-conflict-a-path-to-mediation/ (Accessed on 01/03/2024).

Isenhart. M.W., & Spangle. M., ‘Summary of “Collaborative Approaches to Resolving Conflict” ‘ Available at https://www.beyondintractability.org/bksum/isenhart-collaborative (Accessed on 01/03/2024).

Kaushal. R., & Kwantes. C., ‘The Role of Culture and Personality in Choice of Conflict Management Strategy.’ International Journal of Intercultural Relations 30 (2006) 579– 603.

Leeds. C.A., ‘Managing Conflicts across Cultures: Challenges to Practitioners.’ International Journal of Peace Studies, Volume 2, No. 2, 1997.

May. E., ‘Collaborating Conflict Style Explained In 4 Minutes’ Available at https://www.niagara institute.com/blog/collaborating-conflict-style/ (Accessed on 01/03/2024).

Miroslavov. M., ‘Mastering the Collaborating Conflict Style In 2024’ Available at https://www.officernd.com/blog/collaborating-conflictstyle/#:~:text=It’s%20one%20of%20the%20strat egies,their%20underlying%20needs %20and%20interests. (Accessed on 01/03/2024).

Muigua. K & Kariuki. F., ‘ADR, Access to Justice and Development in Kenya.’ Available at http://kmco.co.ke/wp-content/uploads/2018/08/ADR-access-tojustice-and-development-inKenyaRevised-version-of-20.10.14.pdf (Accessed on 01/03/2024).

Muigua. K., ‘Alternative Dispute Resolution and Access to Justice in Kenya.’ Glenwood Publishers Limited, 2015.

Muigua. K., ‘Reframing Conflict Management in the East African Community: Moving from Alternative to ‘Appropriate’ Dispute Resolution.’ Available at https://kmco.co.ke/wpcontent/uploads/2023/06/ Reframing-ConflictManagement-in-the-East-African-CommunityMoving-from-Alternative-toAppropriate-Dispute-Resolution (Accessed on 01/03/2024).

Muigua. K., ‘Resolving Conflicts through Mediation in Kenya.’ Glenwood Publishers Limited, 2nd Edition., 2017.

Quain. S., ‘The Advantages & Disadvantages of Collaborating Conflict Management’ Available at https://smallbusiness.chron.com/advantagesdisadvantages-collaborating-conflict-management-36052.html (Accessed on 01/03/2024).

Samuel. A., ‘Is the Collaborative Style of Conflict Management the Best Approach?’ Available at https://www.linkedin.com/pulse/collaborative-style-conflictmanagement-best-approach-samuel-ansah (Accessed on 01/03/2024).

United Nations., ‘Land and Conflict’ Available at https://www.un.org/en/landnatural-resources-conflict/pdfs/GN_ExeS_Land%20and%20Conflict.pdf (Accessed on 01/03/2024).

Weiss. J., & Hughes. J., ‘Want Collaboration?: Accept—and Actively Manage— Conflict’ Available at https://hbr.org/2005/03/want-collaboration-accept-andactively-manage-conflict (Accessed on 01/03/2024).

News & Analysis

Opportunities and Challenges of Collaborative Conflict Management

Published

4 weeks agoon

March 24, 2024By

Admin

By Hon. Prof. Kariuki Muigua, OGW, PhD, C.Arb, FCIArb is a Professor of Environmental Law and Dispute Resolution at the University of Nairobi, Member of Permanent Court of Arbitration, Leading Environmental Law Scholar, Respected Sustainable Development Policy Advisor, Top Natural Resources Lawyer, Highly-Regarded Dispute Resolution Expert and Awardee of the Order of Grand Warrior (OGW) of Kenya by H.E. the President of Republic of Kenya. He is the Academic Champion of ADR 2024, the African ADR Practitioner of the Year 2022, the African Arbitrator of the Year 2022, ADR Practitioner of the Year in Kenya 2021, CIArb (Kenya) Lifetime Achievement Award 2021 and ADR Publisher of the Year 2021 and Author of the Kenya’s First ESG Book: Embracing Environmental Social and Governance (ESG) tenets for Sustainable Development” (Glenwood, Nairobi, July 2023) and Kenya’s First Two Climate Change Law Book: Combating Climate Change for Sustainability (Glenwood, Nairobi, October 2023), Achieving Climate Justice for Development (Glenwood, Nairobi, October 2023), Promoting Rule of Law for Sustainable Development (Glenwood, Nairobi, January 2024) and Actualizing the Right to a Clean and Healthy Environment (Glenwood, Nairobi, March 2024)*

One of the key collaborative approaches that can be applied in conflict management is mediation. Mediation has been defined as a method of conflict management where conflicting parties gather to seek solutions to the conflict, with the assistance of a third party who facilitates discussions and the flow of information, and thus aiding in the process of reaching an agreement.

Mediation is usually a continuation of the negotiation process since it arises where parties to a conflict have attempted negotiations, but have reached a deadlock. Parties therefore involve a third party known as a mediator to assist them continue with the negotiations and ultimately break the deadlock. A mediator does not have the power to impose a solution upon the parties but rather facilitates communication, promotes understanding, focuses the parties on their interests, and uses creative problem solving to enable the parties to reach their own agreement.

Some of the core values and principles guiding mediation as a collaborative approach towards conflict management include impartiality, empathy, valued reputation, and confidentiality. It has also been pointed out that mediation has certain attributes which include informality, flexibility, efficiency, confidentiality, party autonomy and the ability to promote expeditious and cost effective management of dispute which makes it an ideal mechanism for managing disputes.

Mediation is an effective mechanism that can foster collaboration due to its potential to build peace and bring people together, binding them towards a common goal. Mediation can also foster effective management of conflicts by building consensus and collaboration. It has been argued that mediation can enhance collaboration towards conflict management due to its emphasis on the need for a mediator who listen to the wants, needs, fears, and concerns of all sides. Therefore, for mediation to be effective in fostering collaboration, the approach must be mild and non-confrontational because the goal is to make all parties feel comfortable expressing their views and opinions.

Another key collaborative approach towards conflict management is negotiation. It has been defined as an informal process that involves parties to a conflict meeting to identify and discuss the issues at hand so as to arrive at a mutually acceptable solution without the help of a third party. Negotiation is one of the most fundamental methods of managing conflicts which offers parties maximum control over the process66. It aims at harmonizing the interests of the parties concerned amicably. Negotiation has been described as the process that creates and fuels collaboration.

Negotiation fosters collaboration since it involves all parties sitting down together, talking through the conflict and working towards a solution together. Negotiation has been described as the most effective collaborative approach towards conflict management since it starts with an understanding by both parties that they must search for solutions that satisfy everyone. It enables parties to a dispute to come together to openly discuss the issue causing tension, actively listen to each other, and come up with mutually satisfactory solutions. If negotiation fails, parties may resort to other collaborative approaches such as mediation and facilitation where they attempt to manage the conflict with the help of a third party.

Facilitation is another key collaborative approach towards conflict management. Facilitation entails a third party known as a facilitator who helps parties to a conflict to understand their common objectives and achieve them without while remaining objective in the discussion. A facilitator assists conflicting parties in achieving consensus on any disagreements so that they have a strong basis for future action.

It has been pointed out that facilitation is effective in fostering collaboration in conflict management particularly in conflicts which are complex in nature or those that involve multiple parties. In such conflicts, it is necessary to seek outside help from a neutral third party to facilitate the discussion as parties work towards mutually acceptable outcomes.

Applying collaborative approaches towards conflict management offers several advantages. It has been pointed out that collaborating results in mutually acceptable solutions. Such solutions can therefore be effective and long lasting negating the likelihood of conflicts reemerging in future. Collaborating signifies joint efforts, gain for both parties and integrated solutions arrived at by consensual decisions.

Collaborating is also very effective when it is necessary to build or maintain relationships since it focuses on the needs and interests of all parties in a dispute. It has been observed that collaborative approaches emphasize trust-building, open communication, and empathizing with each other’s perspectives which goes beyond resolving conflicts to facilitate deeper understandings of each other. Collaborative approaches can therefore lead to better interpersonal connections.

Collaborating can also result in constructive decision-making since encouraging active engagement and open dialogue helps others think outside of the box and explore innovative paths towards conflict management. Further, by encouraging the participation and involvement of all stakeholders, collaboration ensures that everyone feels heard, valued and understood which is very essential in managing conflicts.

In addition, collaborating sets the tone for future conflict resolutions since it gives those involved the shared responsibility to resolve their problems. However, collaborative approaches towards conflict management have also been associated with several drawbacks. For example, it has been observed that collaborative approaches may not be easy to implement since they involve a lot of effort to get an actionable solution. It has been observed that thorough discussions, active participation, and exploring multiple perspectives as envisaged by collaborative approaches take time.

Collaborating may therefore require patience and dedication to ensure all voices are heard and meaningful resolutions are reached. Achieving consensus through collaborative approaches can also be difficult since conflicting opinions, varying conflict goals, and emotional variables can make the consensus-building process challenging and time-consuming. As a result of these challenges, it has been asserted that collaborative approaches towards conflict management are frequently the most difficult and time-consuming to achieve.

Further, it has been argued that over use of collaboration and consensual decision-making may reflect risk aversion tendencies or an inclination to defuse responsibility. Despite these challenges, collaborative approaches towards conflict management are ideal in ensuring win-win and long lasting outcomes. It is therefore necessary to embrace and apply collaborative approaches towards conflict management.

*This is an extract from Kenya’s First Clean and Healthy Environment Book: Actualizing the Right to a Clean and Healthy Environment (Glenwood, Nairobi, January 2024) by Hon. Prof. Kariuki Muigua, OGW, PhD, Professor of Environmental Law and Dispute Resolution, Senior Advocate of Kenya, Chartered Arbitrator, Kenya’s ADR Practitioner of the Year 2021 (Nairobi Legal Awards), ADR Lifetime Achievement Award 2021 (CIArb Kenya), African Arbitrator of the Year 2022, Africa ADR Practitioner of the Year 2022, Member of National Environment Tribunal (NET) Emeritus (2017 to 2023) and Member of Permanent Court of Arbitration nominated by Republic of Kenya and Academic Champion of ADR 2024. Prof. Kariuki Muigua is a foremost Environmental Law and Natural Resources Lawyer and Scholar, Sustainable Development Advocate and Conflict Management Expert in Kenya. Prof. Kariuki Muigua teaches Environmental Law and Dispute resolution at the University of Nairobi School of Law, The Center for Advanced Studies in Environmental Law and Policy (CASELAP) and Wangari Maathai Institute for Peace and Environmental Studies. He has published numerous books and articles on Environmental Law, Environmental Justice Conflict Management, Alternative Dispute Resolution and Sustainable Development. Prof. Muigua is also a Chartered Arbitrator, an Accredited Mediator, the Managing Partner of Kariuki Muigua & Co. Advocates and Africa Trustee Emeritus of the Chartered Institute of Arbitrators 2019-2022. Prof. Muigua is a 2023 recipient of President of the Republic of Kenya Order of Grand Warrior (OGW) Award for his service to the Nation as a Distinguished Expert, Academic and Scholar in Dispute Resolution and recognized among the top 5 leading lawyers and dispute resolution experts in Band 1 in Kenya by the Chambers Global Guide 2024 and was listed in the Inaugural THE LAWYER AFRICA Litigation Hall of Fame 2023 as one of the Top 50 Most Distinguished Litigation Lawyers in Kenya and the Top Arbitrator in Kenya in 2023.

References

Bercovitch. J., ‘Conflict and Conflict Management in Organizations: A Framework for Analysis.’ Available at https://ocd.lcwu.edu.pk/cfiles/International%20Relations/EC/IR403/Conflict.ConflictManagementinOrga nizations.pdf (Accessed on 01/03/2024).

Bercovitch. J., ‘Mediation Success or Failure: A Search for the Elusive Criteria.’ Cardozo Journal of Conflict Resolution, Vol. 7, p 289.

Bloomfield. D., ‘Towards Complementarity in Conflict Management: Resolution and Settlement in Northern Ireland,’ Journal of Peace Research., Volume 32, Issue 2.

Burrell. B., ‘The Five Conflict Styles’ Available at https://web.mit.edu/collaboration/mainsite/ modules/module1/1.11.5.html (Accessed on 01/03/2024).

Demmers. J., ‘Theories of Violent Conflict: An Introduction’ (Routledge, New York, 2012).

Diana. M., ‘From Conflict to Collaboration’ Available at https://www.pmi.org/learning/library/conflict-collaboration-beyond-projectsuccess-1899 (Accessed on 01/03/2024).

Food and Agriculture Organization., ‘Collaborative Conflict Management for Enhanced National Forest Programmes (NFPs)’ Available at https://www.fao.org/3/i2604e/i2604e00.pdf (Accessed on 01/03/2024).

International Organization for Peace Building., ‘Natural Resources and Conflict: A Path to Mediation.’ Available at https://www.interpeace.org/2015/11/naturalresources-and-conflict-a-path-to-mediation/ (Accessed on 01/03/2024).

Isenhart. M.W., & Spangle. M., ‘Summary of “Collaborative Approaches to Resolving Conflict” ‘ Available at https://www.beyondintractability.org/bksum/isenhart-collaborative (Accessed on 01/03/2024).

Kaushal. R., & Kwantes. C., ‘The Role of Culture and Personality in Choice of Conflict Management Strategy.’ International Journal of Intercultural Relations 30 (2006) 579– 603.

Leeds. C.A., ‘Managing Conflicts across Cultures: Challenges to Practitioners.’ International Journal of Peace Studies, Volume 2, No. 2, 1997.

May. E., ‘Collaborating Conflict Style Explained In 4 Minutes’ Available at https://www.niagara institute.com/blog/collaborating-conflict-style/ (Accessed on 01/03/2024).

Miroslavov. M., ‘Mastering the Collaborating Conflict Style In 2024’ Available at https://www.officernd.com/blog/collaborating-conflictstyle/#:~:text=It’s%20one%20of%20the%20strat egies,their%20underlying%20needs %20and%20interests. (Accessed on 01/03/2024).

Muigua. K & Kariuki. F., ‘ADR, Access to Justice and Development in Kenya.’ Available at http://kmco.co.ke/wp-content/uploads/2018/08/ADR-access-tojustice-and-development-inKenyaRevised-version-of-20.10.14.pdf (Accessed on 01/03/2024).

Muigua. K., ‘Alternative Dispute Resolution and Access to Justice in Kenya.’ Glenwood Publishers Limited, 2015.

Muigua. K., ‘Reframing Conflict Management in the East African Community: Moving from Alternative to ‘Appropriate’ Dispute Resolution.’ Available at https://kmco.co.ke/wpcontent/uploads/2023/06/ Reframing-ConflictManagement-in-the-East-African-CommunityMoving-from-Alternative-toAppropriate-Dispute-Resolution (Accessed on 01/03/2024).

Muigua. K., ‘Resolving Conflicts through Mediation in Kenya.’ Glenwood Publishers Limited, 2nd Edition., 2017.

Quain. S., ‘The Advantages & Disadvantages of Collaborating Conflict Management’ Available at https://smallbusiness.chron.com/advantagesdisadvantages-collaborating-conflict-management-36052.html (Accessed on 01/03/2024).

Samuel. A., ‘Is the Collaborative Style of Conflict Management the Best Approach?’ Available at https://www.linkedin.com/pulse/collaborative-style-conflictmanagement-best-approach-samuel-ansah (Accessed on 01/03/2024).

United Nations., ‘Land and Conflict’ Available at https://www.un.org/en/landnatural-resources-conflict/pdfs/GN_ExeS_Land%20and%20Conflict.pdf (Accessed on 01/03/2024).

Weiss. J., & Hughes. J., ‘Want Collaboration?: Accept—and Actively Manage— Conflict’ Available at https://hbr.org/2005/03/want-collaboration-accept-andactively-manage-conflict (Accessed on 01/03/2024).

News & Analysis

Collaborative Approaches towards Conflict Management

Published

4 weeks agoon

March 23, 2024By

Admin

By Hon. Prof. Kariuki Muigua, OGW, PhD, C.Arb, FCIArb is a Professor of Environmental Law and Dispute Resolution at the University of Nairobi, Member of Permanent Court of Arbitration, Leading Environmental Law Scholar, Respected Sustainable Development Policy Advisor, Top Natural Resources Lawyer, Highly-Regarded Dispute Resolution Expert and Awardee of the Order of Grand Warrior (OGW) of Kenya by H.E. the President of Republic of Kenya. He is the Academic Champion of ADR 2024, the African ADR Practitioner of the Year 2022, the African Arbitrator of the Year 2022, ADR Practitioner of the Year in Kenya 2021, CIArb (Kenya) Lifetime Achievement Award 2021 and ADR Publisher of the Year 2021 and Author of the Kenya’s First ESG Book: Embracing Environmental Social and Governance (ESG) tenets for Sustainable Development” (Glenwood, Nairobi, July 2023) and Kenya’s First Two Climate Change Law Book: Combating Climate Change for Sustainability (Glenwood, Nairobi, October 2023), Achieving Climate Justice for Development (Glenwood, Nairobi, October 2023), Promoting Rule of Law for Sustainable Development (Glenwood, Nairobi, January 2024) and Actualizing the Right to a Clean and Healthy Environment (Glenwood, Nairobi, March 2024)*

Conflict management can involve different approaches. These techniques include collaborating, competing, avoiding, accommodating, and compromising. Collaborative approaches towards conflict management have been hailed as the most ideal due to their potential to produce satisfactory and long-term results. Collaborative approaches have been hailed as ensuring efficient and effective management of conflicts towards peace and sustainability.

Collaborative conflict management refers to the use of a wide range of informal approaches where competing or opposing stakeholder groups work together to reach an agreement on a controversial issue. In addition, it has been pointed out that collaborative conflict resolution encourages teams to work through disagreements through empathy, listening, and mutually beneficial solutions. Collaboration, unlike compromise, does not focus on both sides making sacrifices. Instead, in collaborative approaches, both parties come up with mutually beneficial solutions. Collaborating has been identified as a powerful approach to conflict resolution built on cooperation, open communication, and finding win-win outcomes.

It has been argued that among all conflict management techniques, collaborative approaches are the most likely to identify the root cause of a conflict, pinpoint the underlying needs of the parties involved, and come to a win-win outcome for everyone. Through collaboration, all parties to a conflict come together to openly discuss the issue causing tension, actively listen to each other, and work towards a solution that is mutually satisfactory and acceptable to everyone.

It has been pointed out that collaborative conflict management aims to achieve several objectives which include: promoting the participation of diverse or competing stakeholder groups in order to reach agreement on a controversial issue; assisting stakeholders in adopting an attitude that is oriented towards cooperation rather than pursuit of individual interests; establishing new forms of communication and decision making on important issues, and raising awareness of the importance of equity and accountability in stakeholder communication; developing partnerships and strengthening stakeholder networks; creating space for stakeholders to communicate in order to bring about future agreements so that concrete action can be taken; and producing decisions that have a strong base of support.

In addition, it has been observed that collaborative approaches towards conflict management aim to preserve relationships, build trust, and promote long term positive change. Collaborative conflict management is based on certain principles key among them being ensuring open communication, finding common ground, and creating a culture of trust. Collaborative approaches towards conflict management has been hailed as the “win-win” strategy to conflict management. It is an effective means of restoring peace.

Further, it has been argued that collaborative approaches are a better way to conflict management since they encourage freedom of expression, where the conflicting parties express their thoughts and concerns verbally, which makes all parties involved in the dispute feel valued and be aware of each other’s concern. In addition, it has been argued that collaborating sets the tone for future conflict resolution and gives those involved the shared responsibility to manage conflicts prior to escalation.

Managing conflicts in a collaborative way helps to develop trust and strengthen communication channels between the various parties. For example, it has been pointed out that in conflicts related to natural resources, collaborative approaches help in generating inclusive solutions that arise from wider stakeholders’ views, and therefore helps clarify policies, institutions and processes that regulate access to – or control over – natural resources. It has been observed that collaborating entails all parties to a conflict sitting down together, discussing the conflict, and working towards a solution together.

Collaborative approaches towards conflict management have been identified as vital when it is necessary to maintain all parties’ relationships or when the solution itself will have a significant impact on large group of people. In such situations, collaborating ensures a win-win solution is found so that everyone is satisfied which creates the condition for peace and sustainability.

It has been pointed out that for collaborative approaches to be effective, it is necessary for all parties to have collaborating skills such as the ability to use active or effective listening, confront situations in a nonthreatening way, analyze input, and identify underlying concerns. Collaborative approaches towards conflict management are important in fostering effective and long-lasting outcomes. It is therefore necessary to apply collaborative approaches in order to ensure effective and efficient management of conflicts.

*This is an extract from Kenya’s First Clean and Healthy Environment Book: Actualizing the Right to a Clean and Healthy Environment (Glenwood, Nairobi, January 2024) by Hon. Prof. Kariuki Muigua, OGW, PhD, Professor of Environmental Law and Dispute Resolution, Senior Advocate of Kenya, Chartered Arbitrator, Kenya’s ADR Practitioner of the Year 2021 (Nairobi Legal Awards), ADR Lifetime Achievement Award 2021 (CIArb Kenya), African Arbitrator of the Year 2022, Africa ADR Practitioner of the Year 2022, Member of National Environment Tribunal (NET) Emeritus (2017 to 2023) and Member of Permanent Court of Arbitration nominated by Republic of Kenya and Academic Champion of ADR 2024. Prof. Kariuki Muigua is a foremost Environmental Law and Natural Resources Lawyer and Scholar, Sustainable Development Advocate and Conflict Management Expert in Kenya. Prof. Kariuki Muigua teaches Environmental Law and Dispute resolution at the University of Nairobi School of Law, The Center for Advanced Studies in Environmental Law and Policy (CASELAP) and Wangari Maathai Institute for Peace and Environmental Studies. He has published numerous books and articles on Environmental Law, Environmental Justice Conflict Management, Alternative Dispute Resolution and Sustainable Development. Prof. Muigua is also a Chartered Arbitrator, an Accredited Mediator, the Managing Partner of Kariuki Muigua & Co. Advocates and Africa Trustee Emeritus of the Chartered Institute of Arbitrators 2019-2022. Prof. Muigua is a 2023 recipient of President of the Republic of Kenya Order of Grand Warrior (OGW) Award for his service to the Nation as a Distinguished Expert, Academic and Scholar in Dispute Resolution and recognized among the top 5 leading lawyers and dispute resolution experts in Band 1 in Kenya by the Chambers Global Guide 2024 and was listed in the Inaugural THE LAWYER AFRICA Litigation Hall of Fame 2023 as one of the Top 50 Most Distinguished Litigation Lawyers in Kenya and the Top Arbitrator in Kenya in 2023.

References

Bercovitch. J., ‘Conflict and Conflict Management in Organizations: A Framework for Analysis.’ Available at https://ocd.lcwu.edu.pk/cfiles/International%20Relations/EC/IR403/Conflict.ConflictManagementinOrga nizations.pdf (Accessed on 01/03/2024).

Bercovitch. J., ‘Mediation Success or Failure: A Search for the Elusive Criteria.’ Cardozo Journal of Conflict Resolution, Vol. 7, p 289.

Bloomfield. D., ‘Towards Complementarity in Conflict Management: Resolution and Settlement in Northern Ireland,’ Journal of Peace Research., Volume 32, Issue 2.

Burrell. B., ‘The Five Conflict Styles’ Available at https://web.mit.edu/collaboration/mainsite/ modules/module1/1.11.5.html (Accessed on 01/03/2024).

Demmers. J., ‘Theories of Violent Conflict: An Introduction’ (Routledge, New York, 2012).

Diana. M., ‘From Conflict to Collaboration’ Available at https://www.pmi.org/learning/library/conflict-collaboration-beyond-projectsuccess-1899 (Accessed on 01/03/2024).

Food and Agriculture Organization., ‘Collaborative Conflict Management for Enhanced National Forest Programmes (NFPs)’ Available at https://www.fao.org/3/i2604e/i2604e00.pdf (Accessed on 01/03/2024).

International Organization for Peace Building., ‘Natural Resources and Conflict: A Path to Mediation.’ Available at https://www.interpeace.org/2015/11/naturalresources-and-conflict-a-path-to-mediation/ (Accessed on 01/03/2024).

Isenhart. M.W., & Spangle. M., ‘Summary of “Collaborative Approaches to Resolving Conflict” ‘ Available at https://www.beyondintractability.org/bksum/isenhart-collaborative (Accessed on 01/03/2024).

Kaushal. R., & Kwantes. C., ‘The Role of Culture and Personality in Choice of Conflict Management Strategy.’ International Journal of Intercultural Relations 30 (2006) 579– 603.

Leeds. C.A., ‘Managing Conflicts across Cultures: Challenges to Practitioners.’ International Journal of Peace Studies, Volume 2, No. 2, 1997.

May. E., ‘Collaborating Conflict Style Explained In 4 Minutes’ Available at https://www.niagara institute.com/blog/collaborating-conflict-style/ (Accessed on 01/03/2024).

Miroslavov. M., ‘Mastering the Collaborating Conflict Style In 2024’ Available at https://www.officernd.com/blog/collaborating-conflictstyle/#:~:text=It’s%20one%20of%20the%20strat egies,their%20underlying%20needs %20and%20interests. (Accessed on 01/03/2024).

Muigua. K & Kariuki. F., ‘ADR, Access to Justice and Development in Kenya.’ Available at http://kmco.co.ke/wp-content/uploads/2018/08/ADR-access-tojustice-and-development-inKenyaRevised-version-of-20.10.14.pdf (Accessed on 01/03/2024).

Muigua. K., ‘Alternative Dispute Resolution and Access to Justice in Kenya.’ Glenwood Publishers Limited, 2015.

Muigua. K., ‘Reframing Conflict Management in the East African Community: Moving from Alternative to ‘Appropriate’ Dispute Resolution.’ Available at https://kmco.co.ke/wpcontent/uploads/2023/06/ Reframing-ConflictManagement-in-the-East-African-CommunityMoving-from-Alternative-toAppropriate-Dispute-Resolution (Accessed on 01/03/2024).

Muigua. K., ‘Resolving Conflicts through Mediation in Kenya.’ Glenwood Publishers Limited, 2nd Edition., 2017.

Quain. S., ‘The Advantages & Disadvantages of Collaborating Conflict Management’ Available at https://smallbusiness.chron.com/advantagesdisadvantages-collaborating-conflict-management-36052.html (Accessed on 01/03/2024).

Samuel. A., ‘Is the Collaborative Style of Conflict Management the Best Approach?’ Available at https://www.linkedin.com/pulse/collaborative-style-conflictmanagement-best-approach-samuel-ansah (Accessed on 01/03/2024).

United Nations., ‘Land and Conflict’ Available at https://www.un.org/en/landnatural-resources-conflict/pdfs/GN_ExeS_Land%20and%20Conflict.pdf (Accessed on 01/03/2024).

Weiss. J., & Hughes. J., ‘Want Collaboration?: Accept—and Actively Manage— Conflict’ Available at https://hbr.org/2005/03/want-collaboration-accept-andactively-manage-conflict (Accessed on 01/03/2024).

Irene Kiwool: My Track Record and Call to PACT for Better Nairobi LSK

A Toolkit for Customers on accessing Financial Services in Kenya

Way Forward in Applying Collaborative Approaches Towards Conflict Management

Opportunities and Challenges of Collaborative Conflict Management

Collaborative Approaches towards Conflict Management

Way Forward in Fostering the Blue Economy for Sustainability

Trending

-

Lawyers11 months ago

Lawyers11 months agoTHE LAWYER AFRICA Litigation Hall of Fame | Kenya in 2023

-

News & Analysis2 years ago

News & Analysis2 years agoThe Definition and Scope of Biodiversity

-

News & Analysis2 years ago

News & Analysis2 years agoThe Definition, Aspects and Theories of Development

-

News & Analysis2 years ago

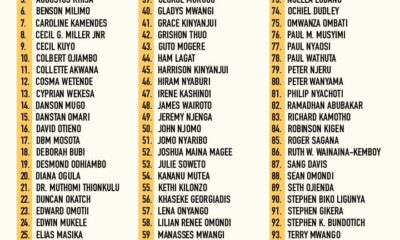

News & Analysis2 years agoTHE TOP 200 ARBITRATORS IN KENYA 2022

-

News & Analysis6 months ago

News & Analysis6 months agoThe Role of NEMA in Pollution Control in Kenya

-

News & Analysis2 years ago

News & Analysis2 years agoRole of Science and Technology in Environmental Management in Kenya

-

Lawyers11 months ago

Lawyers11 months agoTHE LAWYER AFRICA Top 100 Litigation Lawyers in Kenya 2023

-

News & Analysis7 months ago

News & Analysis7 months agoHow to Become an Arbitrator in Kenya