Law Firms

Alert on Changes to Kenya’s Microfinance Act

KOMM Advocates is a leading Top 20 Law Firm in Kenya, offering premier legal services since 2009. With a reputation for innovation, integrity, and exceptional service, we deliver solutions tailored to each client's unique needs. Our experienced team is committed to delivering results that exceed expectations. Our transformation to KOMM Advocates in 2023 marks our journey of growth and regional expansion. We pride ourselves on staying ahead of the curve, blending deep legal knowledge with a keen understanding of client needs, all delivered with the efficiency and pragmatism that defines our practice. In partnership with United Advocates UAE, we offer our clients access to an international network of legal expertise. Whether your legal needs are local or global, KOMM Advocates has the resources and experience to deliver. At KOMM Advocates, it's not just about the law—it’s about the dedicated professionals who bring expertise, care, and commitment to every client’s journey.

Law Firms

What is Legal Compliance Audit?

Gerivia Advocates LLP is a Kenyan and an African boutique law firm based in Nairobi that aims to provide bespoke and novel legal solutions for our clients. We offer specialized legal services in matters relating to Public Procurement and Asset Disposal Law including Procurement Litigation services, general advisory and transactional legal services in Conveyancing & Real Estate, Commercial & Corporate Law and in Aviation Law and Practice.

Our heartfelt mission is: Work in Time. Bespoke. Novel. Responsive. Kindness in Service.

Central to our culture is a commitment to actively listen to our clients, understand their needs and provide them with tailor made simple solutions to suit their specific needs. Because we listen, care and have great attention to detail, we consistently deliver legally accurate and excellent results.

The firm lawyers are approachable, responsive and kind to all our clients. We make/pick calls and write and reply to correspondence especially when we do not feel like and even when we do not have good news for the client. We appreciate that most people who seek the services of lawyers are usually in some form of quagmire (legal or otherwise) and our aim is to lessen their burden.

Law Firms

The Firm Profile of HKM Associates Advocates

HKM Associates, Advocates has over the years grown into a fully fledged legal service dedicated law firm. We are situated in the heart of Westlands, with a vibrant team committed to ensuring delivery of quality legal services to our clients while maintaining professionalism and dignity to both our clients and the profession.

We believe in adapting to the changing legal landscape in Kenya and thus continue to respond where necessary to improve service delivery.

Our primary areas of focus are: – commercial law, conveyance law, secretarial services, banking and securities, Family law, litigation and immigration law.

At HKM Associates, we hold ourselves accountable to the highest standards in meeting our client’s needs accurately and in totality. We are fully dedicated to providing efficient, cost effective and timely services to our clients.

Law Firms

Data Protection in Kenya

Owaga and Associates LLP Advocates is a medium-sized law firm in Nairobi, Kenya, established in 2008. With over 35 years of combined experience in legal practice, we have a deep understanding of the business and socio-political environment in Kenya. We are confident of the team’s dynamic in addressing the client and market needs. We are committed to delivering innovative, client-focused solutions to individuals, businesses, and organizations.

Founded on the principles of integrity, innovation, service, hard work and excellence, we have built a reputation for effectively handling complex legal matters while maintaining personalized attention to each client.

Whether you are navigating a property transaction, resolving a commercial dispute, or protecting your intellectual property, our team works diligently to ensure your legal rights are protected and your interests advanced.

-

Lawyers2 years ago

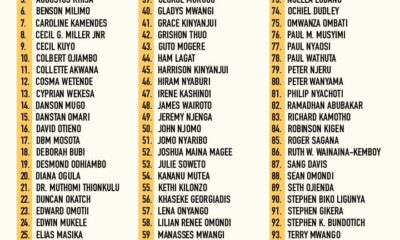

Lawyers2 years agoTHE LAWYER AFRICA Litigation Hall of Fame | Kenya in 2023

-

News & Analysis3 years ago

News & Analysis3 years agoThe Definition and Scope of Biodiversity

-

News & Analysis3 years ago

News & Analysis3 years agoThe Definition, Aspects and Theories of Development

-

Lawyers2 years ago

Lawyers2 years agoTHE LAWYER AFRICA Top 100 Litigation Lawyers in Kenya 2023

-

News & Analysis3 years ago

News & Analysis3 years agoTHE TOP 200 ARBITRATORS IN KENYA 2022

-

News & Analysis1 year ago

News & Analysis1 year agoThe Role of NEMA in Pollution Control in Kenya

-

News & Analysis3 years ago

News & Analysis3 years agoRole of Science and Technology in Environmental Management in Kenya

-

News & Analysis2 years ago

News & Analysis2 years agoHow to Become an Arbitrator in Kenya