By Hon. Dr. Kariuki Muigua, OGW, PhD, C.Arb, FCIArb (Leading Environmental Law Scholar, Sustainable Development Policy Advisor, Natural Resources Lawyer and Dispute Resolution Expert from Kenya), The African Arbitrator of the Year 2022, Kenya’s ADR Practitioner of the Year 2021, CIArb (Kenya) Lifetime Achievement Award 2021 and ADR Publisher of the Year 2021 and Author of the Kenya’s First ESG Book: Embracing Environmental Social and Governance (ESG) tenets for Sustainable Development” (Glenwood, Nairobi, July 2023) and and Kenya’s First Two Climate Change Law Book: Combating Climate Change for Sustainability (Glenwood, Nairobi, October 2023) and Achieving Climate Justice for Development (Glenwood, Nairobi, October 2023)*

The landscape of climate finance presents numerous opportunities. The United Nations Framework Convention on Climate Change (UNFCCC) has established the Green Climate Fund which is mandated to support countries particularly those that are vulnerable to the impacts of climate change, including least developed countries, small island developing states, and African nations. The Green Climate Fund is the world’s largest climate fund and plays a fundamental role in helping developing countries raise and realize their Nationally Determined Contributions (NDC) ambitions towards low-emissions and climate resilient pathways as envisaged under the Paris Agreement.

Since 2015, the Green Climate Fund has approved over $12 billion for projects across more than 125 developing countries to accelerate clean energy transitions, build resilience in the most vulnerable countries, and catalyze private investment. These projects are expected to reduce 2.5 billion tons of emissions and increase the resilience of over 900 million people. The Green Climate Fund therefore plays a key role in unlocking climate finance. Furthermore, at the 2022 United Nations Climate Change Conference/Conference of the Parties of the UNFCC (COP27), a breakthrough agreement was reached to provide loss and damage funding for vulnerable countries hit hard by floods, droughts and other climate disasters. This decision has been lauded as historic since it recognizes the need for finance to respond to loss and damage associated with the severe consequences of climate change.

The decision recognizes the urgent and immediate need for new, additional, predictable and adequate financial resources to assist developing countries that are particularly vulnerable to the adverse effects of climate change in responding to economic and non-economic loss and damage associated with the adverse effects of climate change. The decision supports the UNFCCC commitment to jointly mobilise $100 billion in climate finance per year to support developing countries.

Actualizing the decision of COP 27 and meeting UNFCCC’s commitment on climate funding is vital in unlocking climate finance for development. In addition, developed countries have embraced climate finance by promising to provide financial assistance to developing countries to support their climate change mitigation and adaptation activities as envisaged under the Paris Agreement. The United States of America (USA) pledged to enhance climate support for developing countries to more than $11 billion a year by 2024.

In addition, the USA recently provided $1 billion to the Green Climate Fund (GCF) to support climate change mitigation and adaptation measures in developing countries. Further, the United Kingdom has committed to spend £11.6 billion on International Climate Finance from financial years 2021/2022 to 2025/2026. The UK notes that this funding is crucial in climate action through investments in priority areas including clean energy, adaptation and resilience and sustainable cities, infrastructure and transport. Developing countries therefore play an important role in unlocking climate finance for development.

International and regional financial institutions have also been key catalysts in unlocking climate finance. The World Bank acknowledges that financing transformative climate action is vital for development and to support the poorest people who are most affected by climate change. The World Bank delivered a record USD 31.7 Billion in fiscal year 2022 to help countries address climate change representing a 19% increase from the USD 26.6 Billion reached in the fiscal year 2021. The World Bank continues to be the largest multilateral financier of climate action in developing countries.

In Africa, the African Development Bank is committed to action on climate change and green growth, and to ensuring that development across the continent drives growth that is not only economically empowering but also decarbonized, climate friendly, environmentally sustainable, and socially inclusive.56 In its Climate Action Plan, the African Development Bank recognizes the importance of leveraging climate finance and mobilizing resources for climate action and green growth. The Bank’s climate finance investments increased from $2.1 billion in 2020 to $2.4 billion in 2021 and $3.6 billion in 2022. International and regional financial institutions therefore play a critical role in promoting access to climate finance.

Countries have also furthered their own efforts to unlock climate finance. The Government of Kenya estimates that USD 62 Billion is required to implement the country’s National Determined Contributions (NDCs) between 2020-2030. Kenya has made progress in realizing climate finance through public climate finance, bilateral and multilateral external funding and private climate finance involving both foreign investors and Kenyan investors. The country has also established budget programmes for biodiversity protection as part of its mitigation and adaption measures. Kenya has also adopted a green bond programme to promote financial sector innovation by developing a domestic green bond market. The programme is vital in enhancing the climate resilience of the country by fostering green investments.

In addition, Kenya has pioneered climate finance for pastoralist and vulnerable communities to reduce their vulnerability to climate change. This has enabled pastoralist communities to build community resilience and carry out climate-resilient development in a manner that fosters participation and community inclusion. It has further been observed that county governments in the drylands of Kenya have established local-level climate adaptation funds with technical support from government and non-government organisations. These funds are essential in supporting community-prioritized investments to build climate resilience. The landscape of climate finance in Kenya looks promising due to the availability of public finance, private climate and nature finance and innovative options for climate and nature finance such as green bonds.

From the above discussion, it emerges that there are huge promises for climate finance at the global, regional and national levels. However, several problems hinder effective realization of the ideal of climate finance for development. It has been observed that despite developed economies committing to provide climate financing to developing countries, some of them have not followed through on their commitments. Developed countries have failed to deliver on an agreed climate finance target of USD 100 billion annually by 2020.70 This results inadequacy, imbalance and unpredictability of climate finance flows to developing countries. This has affected implementation of mitigation and adaptation measures in developing countries.

Africa also faces several problems in unlocking climate finance. African governments pledged $ 264 Billion in domestic public resources to combat climate change a figure that falls short of the estimated USD 2.8 trillion required to implement Africa’s Nationally Determined Contributions (NDCs) between 2020 and 2030. It has also been observed that the debt crisis in Africa hinders the Continent’s ability to unlock climate finance. This has affected investor confidence and the ability of African countries to access international markets. Further, it is argued that governance problems limit the potential of Africa to unlock climate concerns due to concerns about transparency, accountability, and efficient allocation of funds aimed towards climate action.

It has also been asserted that limited capacity, expertise and human resources can hinder the potential of developing countries to unlock climate finance due to concerns over ability to implement projects aimed at climate change mitigation and adaptation. It is imperative to address these concerns in order to unlock climate finance in Africa and other developing countries. Further, whereas the decision of COP 27 to establish and operationalize a loss and damage fund, particularly for nations most vulnerable to the climate crisis is commendable, there are still concerns about who should pay into the fund, where this money will come from and which countries will benefit. There is need to address these concerns in order to unlock climate finance.

*This is an extract from the Book: Achieving Climate Justice for Development (Glenwood Publishers, Nairobi, October 2023) by Hon. Dr. Kariuki Muigua, OGW, PhD, Senior Advocate of Kenya, Chartered Arbitrator, Kenya’s ADR Practitioner of the Year 2021 (Nairobi Legal Awards), ADR Lifetime Achievement Award 2021 (CIArb Kenya), African Arbitrator of the Year 2022, Africa ADR Practitioner of the Year 2022, Member of National Environment Tribunal (NET) Emeritus (2017 to 2022) and Member of Permanent Court of Arbitration nominated by Republic of Kenya. Dr. Kariuki Muigua is a foremost Environmental Law and Natural Resources Lawyer and Scholar, Sustainable Development Advocate and Conflict Management Expert in Kenya. Dr. Kariuki Muigua is a Senior Lecturer of Environmental Law and Dispute resolution at the University of Nairobi School of Law and The Center for Advanced Studies in Environmental Law and Policy (CASELAP). He has published numerous books and articles on Environmental Law, Environmental Justice Conflict Management, Alternative Dispute Resolution and Sustainable Development. Dr. Muigua is also a Chartered Arbitrator, an Accredited Mediator, the Managing Partner of Kariuki Muigua & Co. Advocates and Africa Trustee Emeritus of the Chartered Institute of Arbitrators 2019-2022. Dr. Muigua is a 2023 recipient of President of the Republic of Kenya Order of Grand Warrior (OGW) Award for his service to the Nation as a Distinguished Expert, Academic and Scholar in Dispute Resolution and recognized among the top 5 leading lawyers and dispute resolution experts in Band 1 in Kenya by the Chambers Global Guide 2022 and was listed in the Inaugural THE LAWYER AFRICA Litigation Hall of Fame 2023 as one of the Top 50 Most Distinguished Litigation Lawyers in Kenya and the Top Arbitrator in Kenya in 2023.

References

African Development Bank Group., ‘Climate Change.’ Available at https://www.afdb.org/en/topics-and-sectors/sectors/climate-change (Accessed on 10 August 2023).

African Development Bank., ‘African Development Bank Climate Change and Green Growth Strategic Framework: Action Plan 2021-2025.’ Available at https://www.afdb.org/en/documents/climate-change-and-green-growth-strategic-frameworkoperationalising-africas-voice-action-plan-2021-2025 (Accessed on 10 August 2023).

African Union, African Leaders Nairobi Declaration on Climate Change and Call to Action, A declaration made on 6th September 2023 by African leaders attending the Africa Climate Summit 2023 < https://au.int/en/decisions/african-leaders-nairobideclaration-climate-change-and-call-action-preamble> (Accessed on 10 August 2023).

Agyir. K., ‘African Countries Must Act Strategically to Unlock Climate Finance in the Face of a Debt Crisis.’ Available at https://blogs.lse.ac.uk/africaatlse/2023/06/15/african-countries-must-act-strategically-tounlock-climate-finance-in-the-face-of-a-debt-crisis/ (Accessed on 10 August 2023).

Global Center on Adaptation., ‘Kenya Pioneers Climate Finance for Pastoralist and Vulnerable Communities.’ Available at https://gca.org/kenya-pioneers-climate-finance-forpastoralist-and-vulnerable-communities/ (Accessed on 10 August 2023).

Government of the United Kingdom., ‘UK International Climate Finance Strategy.’ Available at https://www.gov.uk/government/publications/uk-international-climate-financestrategy (Accessed on 10 August 2023).

Green Climate Fund., ‘About GCF.’ Available at https://www.greenclimate.fund/about (Accessed on 10 August 2023).

Green Finance Platform., ‘The Kenya Green Bond Programme.’ Available at https://www.greenfinanceplatform.org/policies-and-regulations/kenya-green-bondprogramme (Accessed on 10 August 2023).

International Institute for Environment and Development., ‘Local Climate Finance Mechanism Helping to Fund Community-Prioritised Adaptation.’ Available at https://www.iied.org/local-climate-finance-mechanism-helping-fund-communityprioritised-adaptation (Accessed on 10 August 2023).

Kone. T., ‘For Africa to meet its Climate Goals, Finance is Essential.’ Available at https://climatepromise.undp.org/news-and-stories/africa-meet-its-climate-goalsfinance-essential (Accessed on 10 August 2023).

Magoma. C., ‘A Huge Financing Gap for Climate Action with Public Debt Sustainability Risks Looms in East Africa beyond COP27.’ Available at https://www.acepis.org/a-huge-financing-gap-for-climate-action-with-public-debtsustainability-risks-looms-in-east-africa-beyond-cop27/ (Accessed on 10 August 2023).

Nicholson. K., ‘Kenya Climate and Nature Financing Options Analysis Final Report.’ Available at https://acrobat.adobe.com/link/review?uri=urn%3Aaaid%3Ascds%3AUS%3A5f6c09bfc917-3b18-9c63-4c2c03af8151 (Accessed on 10 August 2023).

Republic of Kenya., ‘Kenya’s Submission on the Objective of the New Collective Quantified Goal On Climate Finance with Respect Article two of the Paris Agreement.’ Available at https://acrobat.adobe.com/link/review?uri=urn%3Aaaid%3Ascds%3AUS%3Aa62dd186- 0d91-3d24-b799-ebe0b32b939a (Accessed on 10 August 2023).

The White House., ‘FACT SHEET: President Biden to Catalyze Global Climate action through the Major Economies Forum on Energy and Climate.’ Available at https://www.whitehouse.gov/briefing-room/statements-releases/2023/04/20/fact-sheetpresident-biden-to-catalyze-global-climate-action-through-the-major-economies-forum-onenergy-and-climate/ (Accessed on 10 August 2023).

The World Bank., ‘10 Things You Should Know About the World Bank Group’s Climate Finance.’ Available at https://www.worldbank.org/en/news/factsheet/2022/09/30/10-things-you-should-knowabout-the-world-bank-group-s-climate-finance (Accessed on 10 August 2023).

UNFCC., ‘Decision -/CP.27 -/CMA.4: Funding Arrangements for Responding to Loss and Damage Associated with the Adverse Effects of Climate Change, Including a Focus on Addressing Loss and Damage.’ Available at https://unfccc.int/sites/default/files/resource/cma4_auv_8f.pdf (Accessed on 10 August 2023).

UNFCC., ‘Five Key Takeaways from COP27.’ Available at https://unfccc.int/processand-meetings/conferences/sharm-el-sheikh-climate-change-conference-november-2022/fivekey-takeaways-from-cop27?gclid=EAIaIQobChMI5_C16jRgAMVDzAGAB1Ikw6NEAAYASAAEgL_QfD_BwE (Accessed on 10 August 2023).

United Nations Environment Programme., ‘COP27 Ends with Announcement of Historic Loss and Damage Fund.’ Available at https://www.unep.org/news-andstories/story/cop27-ends-announcement-historic-loss-and-damage-fund (Accessed on 10 August 2023).

United Nations Framework Convention on Climate Change., ‘Introduction to Climate Finance.’ Available at https://unfccc.int/topics/introduction-to-climatefinance?gclid=EAIaIQobChMI18L91LDRgAMVaIpoCR2_kQzJEAAYAiAAEgI4cfD_BwE (Accessed on 10 August 202310 August 2023.

United Nations Framework Convention on Climate Change., ‘Report of the Conference of the Parties on its Sixteenth Session, held in Cancun from 29 November to 10 December 2010.’ FCCC/CP/2010/7/Add.1.

United Nations., ‘Accessing Climate Finance: Challenges and opportunities for Small Island Developing States.’ Available at https://www.un.org/ohrlls/sites/www.un.org.ohrlls/files/accessing_climate_finance_challenge s_sids_report.pdf (Accessed on 10 August 2023).

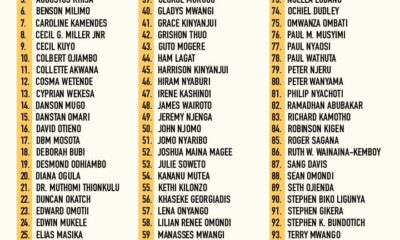

Lawyers2 years ago

Lawyers2 years ago

News & Analysis3 years ago

News & Analysis3 years ago

News & Analysis3 years ago

News & Analysis3 years ago

Lawyers2 years ago

Lawyers2 years ago

News & Analysis3 years ago

News & Analysis3 years ago

News & Analysis1 year ago

News & Analysis1 year ago

News & Analysis3 years ago

News & Analysis3 years ago

News & Analysis1 year ago

News & Analysis1 year ago