By Hon. Prof. Kariuki Muigua, OGW, PhD, C.Arb, FCIArb is a Professor of Environmental Law and Dispute Resolution at the University of Nairobi, Member of Permanent Court of Arbitration, Leading Environmental Law Scholar, Respected Sustainable Development Policy Advisor, Top Natural Resources Lawyer, Highly-Regarded Dispute Resolution Expert and Awardee of the Order of Grand Warrior (OGW) of Kenya by H.E. the President of Republic of Kenya. He is the Academic Champion of ADR 2024, the African ADR Practitioner of the Year 2022, the African Arbitrator of the Year 2022, ADR Practitioner of the Year in Kenya 2021, CIArb (Kenya) Lifetime Achievement Award 2021 and ADR Publisher of the Year 2021 and Author of the Kenya’s First ESG Book: Embracing Environmental Social and Governance (ESG) tenets for Sustainable Development” (Glenwood, Nairobi, July 2023) and Kenya’s First Two Climate Change Law Book: Combating Climate Change for Sustainability (Glenwood, Nairobi, October 2023), Achieving Climate Justice for Development (Glenwood, Nairobi, October 2023) and Promoting Rule of Law for Sustainable Development (Glenwood, Nairobi, January 2024)*

The Nairobi Securities Exchange has developed an ESG Disclosure Manual to guide listed companies in Kenya on ESG reporting. The Manual (ESG Manual) provides that ESG reporting should be on a materiality basis. In financial reporting, materiality is the threshold for influencing the economic decisions of those using an Organisation’s financial statements. A similar concept is also important in ESG reporting.

According to the Nairobi Securities Exchange, listed companies in Kenya have a general awareness of ESG issues and corporate sustainability but there is need for capacity building on how to integrate ESG into business strategies of listed companies and how to report ESG performance in a consistent, transparent and principle-based approach that meets stakeholder expectations. The ESG Disclosures Guidance Manual (ESG Manual) is designed to guide listed companies in Kenya and other organizations interested in ESG reporting on how to collect, analyse, and publicly disclose important ESG information in a way that meets international sustainability reporting standards.

In ESG reporting, “materiality is the principle that determines which relevant topics are sufficiently important that it is essential to report on them.” It is necessary to undertake materiality analysis because not all ESG topics are of equal importance to an organization and an ESG report has to reflect their relative priority of the various topics.

The ESG Manual requires that listed companies have a structured, documented process on assessment of materiality for ESG disclosure topics. It is recommended that a materiality assessment exercise be conducted at least on an annual basis and as part of every new ESG reporting season. The ESG Manual also requires that every organization discloses its approach to materiality within the ESG report.

The Global Reporting Initiative (GRI) gives guideline for what is material by providing that the ESG report should cover topics that Reflect the reporting organisation’s significant economic, environmental, and social impacts; or substantively influence the assessments and decisions of stakeholders. In other words, for a topic to be relevant and potentially material, it should be based on only one of these dimensions.

It is recommended that a materiality assessment grid be used as a structured guide in prioritizing ESG topics to report on. That way, by applying an internally developed rating criteria, organisations can plot ESG topics on a grid or heat map indicating the assessed level of importance considering both dimensions of materiality. In that regard, materiality is dependent on whether a topic is of low or high importance to the stakeholders and the significance of ESG impacts on economy, environment and/or society.

GRI gives detailed guidance that listed companies can refer to when identifying material topics. The starting point is using the sector standards to understand the sector’s content and then deduce the organization content from it. The next step is to consider the topics and impact as described in the sector standard and then identify the actual and potential impact to the organization stakeholders, economy, environment and society. It takes the engagement of the relevant stakeholders and experts on ongoing basis to achieve assessment of the impact of the topics. In the aftermath, the material topics should be tested against the sector standard to prioritize the most significant impacts for reporting.

After this, the material topics should be tested with experts and information users to determine and come up with a comprehensive list of material topics for ESG reporting for the respective organization. The approach applied for each step will vary according to the specific circumstances of the organisation, such as its business model; sector; geographic, cultural and legal operating context; ownership structure; and the nature of its impacts. Given these specific circumstances, the steps should be systematic, documented, replicable, and used consistently in each reporting period. The organisation should document any changes in its approach together with the rationale for those changes and their implications. The organisation’s highest governance body should oversee the process and review and approve the material topics.

The ESG Manual proposes mandatory ESG disclosures for NSE listed companies to help achieve comparability and to facilitate compliance with the CMA Code, relevant international treaties, ESG standards and local regulations. Further, the Capital Markets Authority (CMA) Code of Corporate Governance Practices for Issuers of Securities to the Public in 2015 provides examples of topics that the Boards of listed companies should treat as material.

As per CMA code, material information means any information that may affect the price of an issuer’s securities or influence investment decisions. Listed firms are advised to refer to the Code when selecting material topics for disclosure. The ESG Manual also recommends the Sustainable Development Goals (SDGs) as helpful guide in the identification of material topics and or impact as by aligning organisational objectives with the SDGs, organisations can identify significant impact areas that affect their contribution to the SDGs.

The concept of double-materiality is the latest introduction in the discussions around assessment of materiality in ESG reporting. According to the European Commission Guidelines on Non-financial Reporting, “double-materiality refers to assessing materiality from two perspectives, namely, the extent necessary for an understanding of the company’s development, performance and position” and “in the broad sense of affecting the value of the company”; and environmental and social impact of the company’s activities on a broad range of stakeholders. The concept of double-materiality implies the need to assess the interconnectivity of the two.

A GRI research on how doublemateriality is implemented in ESG reporting, and the benefits and challenges found that identification of financially materiality issues are incomplete if companies do not first assess their impacts on sustainable development. The GRI white paper also revealed that reporting material sustainable development issues can enhance financial performance, improve stakeholder engagement and enable more robust disclosure. Further, it was established that focusing on the impacts of organisations on people and planet, rather than financial materiality, increases engagement with the Sustainable Development Goals (SDGs).

The ESG Manual thus encourages listed companies to assess impact of ESG issues to their organisations (such as climate change and human rights) in addition to their organisations own ESG impacts to society (such as material resource use and emissions) when determining material ESG impacts for disclosure. ESG reporting is thus essential in promoting sustainable development.

This is an extract from Kenya’s First ESG Law Book: Embracing Environmental Social and Governance (ESG) tenets for Sustainable Development” (Glenwood, Nairobi, July 2023) by Hon. Prof. Kariuki Muigua, OGW, PhD, Professor of Environmental Law and Dispute Resolution, Senior Advocate of Kenya, Chartered Arbitrator, Kenya’s ADR Practitioner of the Year 2021 (Nairobi Legal Awards), ADR Lifetime Achievement Award 2021 (CIArb Kenya), African Arbitrator of the Year 2022, Africa ADR Practitioner of the Year 2022, Member of National Environment Tribunal (NET) Emeritus (2017 to 2023) and Member of Permanent Court of Arbitration nominated by Republic of Kenya and Academic Champion of ADR 2024. Prof. Kariuki Muigua is a foremost Environmental Law and Natural Resources Lawyer and Scholar, Sustainable Development Advocate and Conflict Management Expert in Kenya. Prof. Kariuki Muigua teaches Environmental Law and Dispute resolution at the University of Nairobi School of Law, The Center for Advanced Studies in Environmental Law and Policy (CASELAP) and Wangari Maathai Institute for Peace and Environmental Studies. He has published numerous books and articles on Environmental Law, Environmental Justice Conflict Management, Alternative Dispute Resolution and Sustainable Development. Prof. Muigua is also a Chartered Arbitrator, an Accredited Mediator, the Managing Partner of Kariuki Muigua & Co. Advocates and Africa Trustee Emeritus of the Chartered Institute of Arbitrators 2019-2022. Prof. Muigua is a 2023 recipient of President of the Republic of Kenya Order of Grand Warrior (OGW) Award for his service to the Nation as a Distinguished Expert, Academic and Scholar in Dispute Resolution and recognized among the top 5 leading lawyers and dispute resolution experts in Band 1 in Kenya by the Chambers Global Guide 2024 and was listed in the Inaugural THE LAWYER AFRICA Litigation Hall of Fame 2023 as one of the Top 50 Most Distinguished Litigation Lawyers in Kenya and the Top Arbitrator in Kenya in 2023.

References

Adams, C.A., Alhamood, A., He, X., Tian, J., Wang, L. and Wang, Y. (2021) The Double-Materiality Concept: Application and Issues, published by the Global Reporting Initiative (GRI) as a White Paper, Available at: https://www.globalreporting.org/media/jrbntbyv/griwhitepaper-publications.pdf (accessed on 21/07/2022)

Capital Markets Authority., Code of Corporate Governance Practices for Issuers of Securities to the Public in 2015, Legal Notice No. 1420.

Cedric.R., ‘Accountability of Multinational Corporations for Human Rights Abuses.” Utrecht Law Review 14.2 (2018): 1-5.’

CFI, ESG (Environmental, Social and Governance), Available at: https://corporatefinanceinstitute.com/resources/knowledge/other/esg-environmental-socialgovernance/ (accessed on 21/07/2022).

Create Research, “Passive Investing 2021: Rise of the social pillar of ESG,” Available at: https://cdn.efundresearch.com/files/RcfPdrQdAaVI9tiBgrgLq4baO7Wciz6eepZTODEO.pdf (accessed on 21/07/2022).

De Francesco. A.J., ‘The impact of sustainability on the investment environment.’ Journal of European Real Estate Research (2008).

Erkens. D.H, et al Corporate governance in the 2007–2008 financial crisis: Evidence from financial institutions worldwide.” Journal of corporate finance 18.2 (2012): 389-411.

European Commission ‘Guidelines on Non-Financial Reporting’, available at https://ec.europa.eu/info/publications/non-financial-reporting-guidelines_en (accessed on 21/07/2022).

Fonseca.A et al., ‘Sustainability reporting among mining corporations: a constructive critique of the GRI approach.” Journal of cleaner production 84 (2014): 70- 83.’

Global Reporting Initiative., ‘ESG Standards, Frameworks and Everything in Between’ available at https://www.globalreporting.org/media/jxkgrggd/gri-perspective-esgstandards-frameworks.pdf (accessed on 21/07/2022).

GRI., ‘The Global Standards for Sustainability Reporting’ available at https://www.globalreporting.org/standards/ (accessed on 21/07/2022).

Mariarosaria. S & Scarpato. D ‘Sustainable Consumption: How Does Social Media Affect Food Choices?’ Journal of Cleaner Production 277 (2020): 124036.

Martin.C et al., ‘Corporate governance and the 2008–09 Financial Crisis.” Corporate Governance: An International Review 19.5 (2011): 399-404.

Muigua. K., ‘What are the Material Issues for ESG Reporting in Kenya?’ available at https://thelawyer.africa/2022/06/05/material-issues-for-esg-reporting-in-kenya/ (accessed on 21/07/2022).

Muigua.K., ‘Introduction to ESG (Environmental, Social and Governance) available at https://thelawyer.africa/2022/02/04/esg-environmental-social-and-governance/ (accessed on 22/07/2022).

Nairobi Securities Exchange, ‘ESG Disclosures Guidance Manual’, available at https://sseinitiative.org/wp-content/uploads/2021/12/NSE-ESG-Disclosures-Guidance.pdf (accessed on 21/07/2022).

Norton Rose Fulbright, “Environmental, Social and Governance,” Available at: https://www.nortonrosefulbright.com/en/services/203f40d1/environmental-social-andgovernance-esg (accessed on 21/07/2022).

OECD (2021), ESG Investing and Climate Transition: Market Practices, Issues and Policy Considerations, OECD Paris, https://www.oecd.org/finance/ESG-investing-andclimatetransition-Market-practices-issues-and-policy-considerations.pdf (accessed on 21/07/2022).

OECD., ‘Environmental Social and Governance (ESG) Investing’ available at https://www.oecd.org/finance/esg-investing.htm (accessed on 21/07/2022).

Ojiambo, S., “Leadership of the UN Global Compact: Message of CEO and Executive Director,” Available at: https://www.unglobalcompact.org/about/governance/executive-director (accessed on 21/07/2022).

RL360, “Governance-The G in ESG,” Available at: https://www.rl360.com/row/funds/investment-definitions/g-in-esg.htm (accessed on 21/07/2022).

Ruth.J., ‘The Convergence of Financial and ESG Materiality: Taking Sustainability Mainstream.” American Business Law Journal 56.3 (2019): 645-702.’

Standard Chartered Singapore, “The S in ESG,” Available at: https://www.sc.com/sg/wealth/insights/the-s-in-esg/ (accessed on 21/07/2022).

Stuart. L.G et al., ‘Firms and social responsibility: A review of ESG and CSR research in corporate finance.’ Journal of Corporate Finance 66 (2021): 101889.

The Financial Times Lexicon, Available at: https://markets.ft.com/glossary/searchLetter.asp?letter=E (accessed on 21/07/2022).

United Nations, Department of Economic and Social Affairs, ‘Sustainable Development’ available at https://sdgs.un.org/goals (accessed on 21/07/2022).

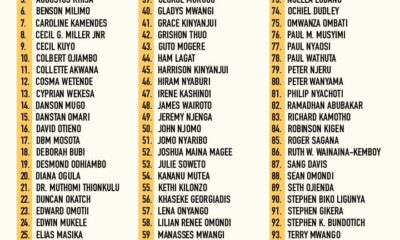

Lawyers2 years ago

Lawyers2 years ago

News & Analysis3 years ago

News & Analysis3 years ago

News & Analysis3 years ago

News & Analysis3 years ago

Lawyers2 years ago

Lawyers2 years ago

News & Analysis3 years ago

News & Analysis3 years ago

News & Analysis1 year ago

News & Analysis1 year ago

News & Analysis3 years ago

News & Analysis3 years ago

News & Analysis1 year ago

News & Analysis1 year ago