By Hon. Dr. Kariuki Muigua, OGW, PhD, C.Arb, FCIArb (Leading Environmental Law Scholar, Sustainable Development Policy Advisor, Natural Resources Lawyer and Dispute Resolution Expert from Kenya), The African Arbitrator of the Year 2022, Kenya’s ADR Practitioner of the Year 2021, CIArb (Kenya) Lifetime Achievement Award 2021 and ADR Publisher of the Year 2021 and Author of the Kenya’s First ESG Book: Embracing Environmental Social and Governance (ESG) tenets for Sustainable Development” (Glenwood, Nairobi, July 2023) and and Kenya’s First Two Climate Change Law Book: Combating Climate Change for Sustainability (Glenwood, Nairobi, October 2023) and Achieving Climate Justice for Development (Glenwood, Nairobi, October 2023)*

The African Leaders Nairobi Declaration on Climate Change and Call to Action, adopted during the Africa Climate Summit in Nairobi went a long way in addressing the Climate Finance gaps in Africa. In the first place, it called upon the global community to act with urgency in reducing emissions, fulfilling its obligations, keeping past promises, and supporting the continent in addressing climate change, specifically to, inter alia, honour the commitment to provide $100 billion in annual climate finance, as promised 14 years ago at the Copenhagen conference.

The African leaders also called for the operationalization of the Loss & Damage fund as agreed at COP 27 and resolve for a measurable Global Goal on Adaptation (GGA) with indicators and targets to enable assessment of progress against negative impacts of climate change. They also committed to build effective partnerships between Africa and other regions, to meet the needs for financial, technical and technological support, and knowledge sharing for climate change adaptation.

The African Heads of States and Governments who participated in the Africa Climate Summit in Nairobi, as a call to action, also invited Development Partners from both the global south and north to synchronise and harmonise their technical and financial resources aimed at Africa. This collaboration aims to facilitate the sustainable utilisation of Africa’s natural resources, thereby advancing the continent’s transition towards low carbon development and supporting global decarbonization efforts.

In addition to emphasizing the decision 31/COP 27, the leaders reiterated the need for a global shift towards a low-carbon economy. This transition is estimated to necessitate an annual investment of at least USD 4-6 trillion. Accomplishing such funding requires a fundamental transformation of the financial system, including its structures and processes. This transformation should involve the active participation of governments, central banks, commercial banks, institutional investors, and other financial stakeholders.

As part of the call to action, the African leaders called for collective global action to mobilise the necessary capital for both development and climate action, echoing the statement of the Paris Summit for a New Global Financing Pact, that no country should ever have to choose between development aspirations and climate action. The leaders also called for concrete, time-bound action on the proposals to reform the multilateral financial system currently under discussion specifically to: Better leveraging of the balance sheets of Multilateral development banks, or MDBs to scale up concessional finance to at least $500b per year. They also proposed consideration of a new Special Drawing Rights (SDRs) issue for climate crisis response of at least the same magnitude as the Covid 19 issue ($650b).

In addition, they called for decisive action on the Promotion of inclusive and effective international tax cooperation at the United Nations (Resolution A/C.2/77/L.11/REV.1)– with the aim to reduce Africa’s loss of $ 27 billion annual corporate tax revenue through profit shifting, by at least 50% by 2030 and 75% by 2050. The Africa Development Bank (AfDB) made a significant announcement during the summit, stating that it will provide $23 billion in financing over the next 27 years to the Africa Climate Fund. This funding is specifically intended to support green growth, as well as activities related to mitigation and adaptation in the renewable energy sector. This announcement has been seen as further strengthening the ongoing efforts at the summit to increase investments in renewable energy. The United Arab Emirates (UAE) made a financial commitment of $4.5 billion, while Germany gave $482.31 million to support the advancement of green energy infrastructure.

These African initiatives can go a long way in addressing the problems that affect access to climate finance including the failure by developed countries to deliver their promise on climate funding and problems in developing countries including debt crises and unfavourable investment environment. Further, they can go a long way in changing and enhancing the landscape of climate finance especially in identifying and mobilizing effective and appropriate financing for climate action. It is refreshing to see African financial institutions such as AfDB taking steps geared at enhancing climate finance. Even countries such as Kenya have taken steps to pass the requisite framework for facilitating investing in green products including green bonds. Still, there is more that African countries can do in creating a viable environment for climate finance and unlocking climate finance for development.

*This is an extract from the Book: Achieving Climate Justice for Development (Glenwood Publishers, Nairobi, October 2023) by Hon. Dr. Kariuki Muigua, OGW, PhD, Senior Advocate of Kenya, Chartered Arbitrator, Kenya’s ADR Practitioner of the Year 2021 (Nairobi Legal Awards), ADR Lifetime Achievement Award 2021 (CIArb Kenya), African Arbitrator of the Year 2022, Africa ADR Practitioner of the Year 2022, Member of National Environment Tribunal (NET) Emeritus (2017 to 2022) and Member of Permanent Court of Arbitration nominated by Republic of Kenya. Dr. Kariuki Muigua is a foremost Environmental Law and Natural Resources Lawyer and Scholar, Sustainable Development Advocate and Conflict Management Expert in Kenya. Dr. Kariuki Muigua is a Senior Lecturer of Environmental Law and Dispute resolution at the University of Nairobi School of Law and The Center for Advanced Studies in Environmental Law and Policy (CASELAP). He has published numerous books and articles on Environmental Law, Environmental Justice Conflict Management, Alternative Dispute Resolution and Sustainable Development. Dr. Muigua is also a Chartered Arbitrator, an Accredited Mediator, the Managing Partner of Kariuki Muigua & Co. Advocates and Africa Trustee Emeritus of the Chartered Institute of Arbitrators 2019-2022. Dr. Muigua is a 2023 recipient of President of the Republic of Kenya Order of Grand Warrior (OGW) Award for his service to the Nation as a Distinguished Expert, Academic and Scholar in Dispute Resolution and recognized among the top 5 leading lawyers and dispute resolution experts in Band 1 in Kenya by the Chambers Global Guide 2022 and was listed in the Inaugural THE LAWYER AFRICA Litigation Hall of Fame 2023 as one of the Top 50 Most Distinguished Litigation Lawyers in Kenya and the Top Arbitrator in Kenya in 2023.

References

‘African Leaders Seek Global Taxes for Climate Change at Nairobi Summit’ accessed 8 October 2023.

African Development Bank Group., ‘Climate Change.’ Available at https://www.afdb.org/en/topics-and-sectors/sectors/climate-change (Accessed on 10 August 2023).

African Development Bank., ‘African Development Bank Climate Change and Green Growth Strategic Framework: Action Plan 2021-2025.’ Available at https://www.afdb.org/en/documents/climate-change-and-green-growth-strategic-frameworkoperationalising-africas-voice-action-plan-2021-2025 (Accessed on 10 August 2023).

African Union, African Leaders Nairobi Declaration on Climate Change and Call to Action, A declaration made on 6th September 2023 by African leaders attending the Africa Climate Summit 2023 < https://au.int/en/decisions/african-leaders-nairobideclaration-climate-change-and-call-action-preamble> (Accessed on 10 August 2023).

African Union, African Leaders Nairobi Declaration on Climate Change and Call to Action, A declaration made on 6th September 2023 by African leaders attending the Africa Climate Summit 2023.

African Union, African Leaders Nairobi Declaration on Climate Change and Call to Action, A declaration made on 6th September 2023 by African leaders attending the Africa Climate Summit 2023 < https://au.int/en/decisions/african-leaders-nairobideclaration-climate-change-and-call-action-preamble> Accessed on 10 August 2023.

Agyir. K., ‘African Countries Must Act Strategically to Unlock Climate Finance in the Face of a Debt Crisis.’ Available at https://blogs.lse.ac.uk/africaatlse/2023/06/15/african-countries-must-act-strategically-tounlock-climate-finance-in-the-face-of-a-debt-crisis/ (Accessed on 10 August 2023).

Asian Development Bank., ‘Unlocking Islamic Climate Finance.’ Available at https://www.adb.org/sites/default/files/publication/838201/unlocking-islamic-climatefinance.pdf (Accessed on 10 August 2023).

Georgieva. K et al., ‘Poor and Vulnerable Countries Need Support to Adapt to Climate Change.’ Available at https://www.imf.org/en/Blogs/Articles/2022/03/23/blog032322-poor-and-vulnerablecountris-need-support-to-adapt-to-climate-change (Accessed on 10 August 2023).

Global Center on Adaptation., ‘Kenya Pioneers Climate Finance for Pastoralist and Vulnerable Communities.’ Available at https://gca.org/kenya-pioneers-climate-finance-forpastoralist-and-vulnerable-communities/ (Accessed on 10 August 2023).

Government of the United Kingdom., ‘UK International Climate Finance Strategy.’ Available at https://www.gov.uk/government/publications/uk-international-climate-financestrategy (Accessed on 10 August 2023).

Green Climate Fund., ‘About GCF.’ Available at https://www.greenclimate.fund/about (Accessed on 10 August 2023).

Green Climate Fund., ‘Enhancing Climate Finance and Investment in LAC Banking Sector.’ Available at https://www.greenclimate.fund/document/enhancing-climate-financeand-investment-lac-bankingsector#:~:text=These%20processes%20undertaken%20individually%20by,monitoring%20a nd%20following%20up%20impacts%2C (Accessed on 10 August 2023).

Green Finance Platform., ‘The Kenya Green Bond Programme.’ Available at https://www.greenfinanceplatform.org/policies-and-regulations/kenya-green-bondprogramme (Accessed on 10 August 2023).

International Institute for Environment and Development., ‘Local Climate Finance Mechanism Helping to Fund Community-Prioritised Adaptation.’ Available at https://www.iied.org/local-climate-finance-mechanism-helping-fund-communityprioritised-adaptation (Accessed on 10 August 2023).

Kone. T., ‘For Africa to meet its Climate Goals, Finance is Essential.’ Available at https://climatepromise.undp.org/news-and-stories/africa-meet-its-climate-goals-financeessential (Accessed on 10 August 2023).

Kone. T., ‘For Africa to meet its Climate Goals, Finance is Essential.’ Available at https://climatepromise.undp.org/news-and-stories/africa-meet-its-climate-goalsfinance-essential (Accessed on 10 August 2023).

Magoma. C., ‘A Huge Financing Gap for Climate Action with Public Debt Sustainability Risks Looms in East Africa beyond COP27.’ Available at https://www.acepis.org/a-huge-financing-gap-for-climate-action-with-public-debtsustainability-risks-looms-in-east-africa-beyond-cop27/ (Accessed on 10 August 2023).

Nicholson. K., ‘Kenya Climate and Nature Financing Options Analysis Final Report.’ Available at https://acrobat.adobe.com/link/review?uri=urn%3Aaaid%3Ascds%3AUS%3A5f6c09bfc917-3b18-9c63-4c2c03af8151 (Accessed on 10 August 2023).

Republic of Kenya., ‘Kenya’s Submission on the Objective of the New Collective Quantified Goal On Climate Finance with Respect Article two of the Paris Agreement.’ Available at https://acrobat.adobe.com/link/review?uri=urn%3Aaaid%3Ascds%3AUS%3Aa62dd186- 0d91-3d24-b799-ebe0b32b939a (Accessed on 10 August 2023).

Riegler. M., ‘Towards a Definition of Sustainable Banking – A Consolidated Approach in the Context of Guidelines and Strategies.’ International Journal of Corporate Social Responsibility, (2023), 8(5).

Roberts. J et al., ‘Rebooting a Failed Promise of Climate Finance.’ Available at https://www.researchgate.net/profile/RomainWeikmans/publication/349426191_Rebooting_a_failed_promise_of_climate_finance/links/60 924fbda6fdccaebd093ff2/Rebooting-a-failed-promise-of-climate-finance.pdf (Accessed on 10 August 2023).

Samuwai. J., & Hills. J., ‘Assessing Climate Finance Readiness in the Asia-Pacific Region.’ Sustainability, Volume 10, No. 4 (2018).

Stuart. L.G et al., ‘Firms and social responsibility: A review of ESG and CSR Research in Corporate Finance.’ Journal of Corporate Finance 66 (2021): 101889.

The White House., ‘FACT SHEET: President Biden to Catalyze Global Climate action through the Major Economies Forum on Energy and Climate.’ Available at https://www.whitehouse.gov/briefing-room/statements-releases/2023/04/20/fact-sheetpresident-biden-to-catalyze-global-climate-action-through-the-major-economies-forum-onenergy-and-climate/ (Accessed on 10 August 2023).

The World Bank., ‘10 Things You Should Know About the World Bank Group’s Climate Finance.’ Available at https://www.worldbank.org/en/news/factsheet/2022/09/30/10-things-you-should-knowabout-the-world-bank-group-s-climate-finance (Accessed on 10 August 2023).

UNFCC., ‘Decision -/CP.27 -/CMA.4: Funding Arrangements for Responding to Loss and Damage Associated with the Adverse Effects of Climate Change, Including a Focus on Addressing Loss and Damage.’ Available at https://unfccc.int/sites/default/files/resource/cma4_auv_8f.pdf (Accessed on 10 August 2023).

UNFCC., ‘Five Key Takeaways from COP27.’ Available at https://unfccc.int/processand-meetings/conferences/sharm-el-sheikh-climate-change-conference-november-2022/fivekey-takeaways-from-cop27?gclid=EAIaIQobChMI5_C16jRgAMVDzAGAB1Ikw6NEAAYASAAEgL_QfD_BwE (Accessed on 10 August 2023).

United Nations Environment Programme., ‘COP27 Ends with Announcement of Historic Loss and Damage Fund.’ Available at https://www.unep.org/news-andstories/story/cop27-ends-announcement-historic-loss-and-damage-fund (Accessed on 10 August 2023).

United Nations Framework Convention on Climate Change., ‘Climate Finance Access and Mobilization Strategy for The Least Developed Countries in Asia: 2022- 2030.’ Available at https://unfccc.int/sites/default/files/resource/UNFCCC_NBF_SD_AsianLDCA_final.pdf (Accessed on 10 August 2023).

United Nations Framework Convention on Climate Change., ‘Climate Change.’ Available at https://unfccc.int/topics/climate-finance/the-big-picture/climate-finance-in-thenegotiations/climate-finance (Accessed on 10 August 2023).

United Nations Framework Convention on Climate Change., ‘Introduction to Climate Finance.’ Available at https://unfccc.int/topics/introduction-to-climatefinance?gclid=EAIaIQobChMI18L91LDRgAMVaIpoCR2_kQzJEAAYAiAAEgI4cfD_BwE (Accessed on 10 August 202310 August 2023.

United Nations Framework Convention on Climate Change., ‘Report of the Conference of the Parties on its Sixteenth Session, held in Cancun from 29 November to 10 December 2010.’ FCCC/CP/2010/7/Add.1.

United Nations., ‘Accessing Climate Finance: Challenges and opportunities for Small Island Developing States.’ Available at https://www.un.org/ohrlls/sites/www.un.org.ohrlls/files/accessing_climate_finance_challenge s_sids_report.pdf (Accessed on 10 August 2023).

Zhixia, C., et al. ‘Green Banking for Environmental Sustainability-Present Status and Future Agenda: Experience from Bangladesh.’ Asian Economic and Financial Review, (2018) 8(5), 571–585.

Zimmermann, S., ‘Same but Different: How and Why Banks Approach Sustainability.’ Sustainability, (2019) 11(8), 2267.

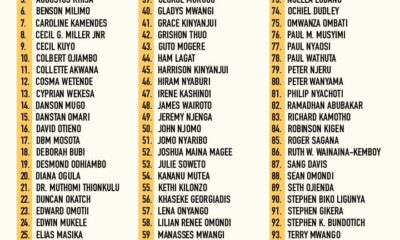

Lawyers1 year ago

Lawyers1 year ago

News & Analysis3 years ago

News & Analysis3 years ago

News & Analysis3 years ago

News & Analysis3 years ago

Lawyers1 year ago

Lawyers1 year ago

News & Analysis2 years ago

News & Analysis2 years ago

News & Analysis1 year ago

News & Analysis1 year ago

News & Analysis3 years ago

News & Analysis3 years ago

News & Analysis1 year ago

News & Analysis1 year ago