By Hon. Prof. Kariuki Muigua, OGW, PhD, C.Arb, FCIArb is a Professor of Environmental Law and Dispute Resolution at the University of Nairobi, Member of Permanent Court of Arbitration, Leading Environmental Law Scholar, Respected Sustainable Development Policy Advisor, Top Natural Resources Lawyer, Highly-Regarded Dispute Resolution Expert and Awardee of the Order of Grand Warrior (OGW) of Kenya by H.E. the President of Republic of Kenya. He is The African ADR Practitioner of the Year 2022, The African Arbitrator of the Year 2022, ADR Practitioner of the Year in Kenya 2021, CIArb (Kenya) Lifetime Achievement Award 2021 and ADR Publisher of the Year 2021 and Author of the Kenya’s First ESG Book: Embracing Environmental Social and Governance (ESG) tenets for Sustainable Development” (Glenwood, Nairobi, July 2023) and Kenya’s First Two Climate Change Law Book: Combating Climate Change for Sustainability (Glenwood, Nairobi, October 2023), Achieving Climate Justice for Development (Glenwood, Nairobi, October 2023) and Promoting Rule of Law for Sustainable Development (Glenwood, Nairobi, January 2024)*

ESG has also been defined as a concept that seeks to achieve sustainable, responsible and ethical investment by incorporating Environmental, Social and Governance factors in corporate decision making. ESG integration involves incorporating environmental, social and governance indicators into investment and business decision-making processes. It has been correctly observed that the integration of the ESG criteria has become an instrument responsible for defining, planning, operationalizing and executing the actions of corporations directed at environmental prevention and preservation, in addition to social responsibility and the quality performance of their activities. The concept of ESG is pertinent in the sustainability agenda.

The rise of ESG has been necessitated by global sustainability problems including climate change, corporate corruption and financial inequality. It has been pointed out that ESG includes key elements around environmental and social impact, as well as how governance structures can be amended to maximize stakeholder well-being towards sustainability. It incorporates Environmental factors such as climate change considerations, energy efficiency, carbon emissions, waste management and resource consumption; Social factors including human rights, labour relations, employee welfare, community engagement, diversity and inclusion; and Governance issues such as board diversity, transparency and internal control systems towards achieving sustainability.

Realizing ESG tenets is therefore necessary in order to achieve sustainability. ESG is vital in fostering sustainable, responsible or ethical investments. It has been argued that ESG is usually a standard and strategy used by investors to evaluate corporate behavior and future financial performance of organizations. ESG therefore stems from sustainable and responsible investments. Sustainable investing entails balancing traditional investing with Environmental, Social, and Governance-related (ESG) insights in order to improve long-term outcomes. Sustainable investing refers to a range of practices in which investors aim to achieve financial returns while promoting long-term environmental or social value. It ensures that organizations are not judged solely on short-term financial gains but on a broader picture of what and how they contribute to society.

It has been argued that investments are sustainable if their total economic, social and environmental benefits can be predicted to outweigh their total cost. Economic sustainability of investments refers to the long-term viability of a market-based activity for all actors involved. Social sustainability consists of effects of investments on human development, individual well-being and collective outcomes such as peace and social cohesion. Further, environmental sustainability is achieved investment activities do not surpass the boundaries of ecological systems that support life on Earth (considering issues such as climate change, chemical pollution and freshwater use).

ESG is central to realizing sustainable investing. It has been argued that ESG fosters socially responsible and sustainable investments by enabling investors to incorporate their values and concerns (such as environmental and social concerns) into their selection of investments instead of simply considering the potential profitability and/or risk presented by an investment opportunity. ESG presents a set of non-financial performance indicators that are vital in ensuring sustainable, ethical and responsible investments. It has been observed that demand for non-financial information has risen considerably over the past few decades in order to enhance socially responsible investment therefore challenging the traditional capital market’s view which assumes that an organization’s responsibility is solely to its shareholders.

ESG enables organizations to foster sustainable investments by also seeking to address values beyond financial returns. ESG therefore promotes sustainable investing by focusing on nonfinancial dimensions of a firm’s performance. It specifically relates to the impact of the company on the environment, social progress, and good governance. It has been pointed out that the concept of ESG is usually a standard and strategy used by investors to evaluate corporate behavior and future financial performance. As an investment concept for evaluating the sustainability of organizations, the three tenets of ESG are the key factors to be considered in the process of investment analysis and decision making. In addition, the ESG tenets can help to measure the sustainability and social impact of business activities.

Due to its importance in fostering sustainable investment, it has been correctly observed that ESG factors are becoming increasingly important to investors and customers. As a result, investors are looking for companies that are socially responsible and have a positive impact on the environment and society while customers are also looking for companies that share their values and have a positive impact on the community. Consequently, how companies handle ESG issues has become a major concern especially for investors, customers and other key stakeholders. It has been pointed out the importance of ESG is evidenced by the change in the legal and regulatory landscapes around the world to reflect the expectations of investors, customers, employees and other stakeholders.

ESG factors now apply in many areas increasingly driving investment decisions and commercial contracts to company strategy and culture. According to the Organisation for Economic Co-operation and Development (OECD), the growth of ESG approaches by investors has been driven by private and public sector initiatives to reach the objectives of the Paris Agreement and the Sustainable Development Goals (SDGs). This has seen the incorporation of climate transition factors among other ESG considerations into investment decisions and the growth of what has come to be known as ESG investing as a leading form of sustainable finance for long-term value and alignment with societal values36. ESG is therefore a key component of sustainable investment.

*This is an extract from the Book: Promoting Rule of Law for Sustainable Development (Glenwood, Nairobi, January 2024) by Hon. Prof. Kariuki Muigua, OGW, PhD, Professor of Environmental Law and Dispute Resolution, Senior Advocate of Kenya, Chartered Arbitrator, Kenya’s ADR Practitioner of the Year 2021 (Nairobi Legal Awards), ADR Lifetime Achievement Award 2021 (CIArb Kenya), African Arbitrator of the Year 2022, Africa ADR Practitioner of the Year 2022, Member of National Environment Tribunal (NET) Emeritus (2017 to 2022) and Member of Permanent Court of Arbitration nominated by Republic of Kenya. Prof. Kariuki Muigua is a foremost Environmental Law and Natural Resources Lawyer and Scholar, Sustainable Development Advocate and Conflict Management Expert in Kenya. Prof. Kariuki Muigua teaches Environmental Law and Dispute resolution at the University of Nairobi School of Law, The Center for Advanced Studies in Environmental Law and Policy (CASELAP) and Wangari Maathai Institute for Peace and Environmental Studies. He has published numerous books and articles on Environmental Law, Environmental Justice Conflict Management, Alternative Dispute Resolution and Sustainable Development. Prof. Muigua is also a Chartered Arbitrator, an Accredited Mediator, the Managing Partner of Kariuki Muigua & Co. Advocates and Africa Trustee Emeritus of the Chartered Institute of Arbitrators 2019-2022. Prof. Muigua is a 2023 recipient of President of the Republic of Kenya Order of Grand Warrior (OGW) Award for his service to the Nation as a Distinguished Expert, Academic and Scholar in Dispute Resolution and recognized among the top 5 leading lawyers and dispute resolution experts in Band 1 in Kenya by the Chambers Global Guide 2022 and was listed in the Inaugural THE LAWYER AFRICA Litigation Hall of Fame 2023 as one of the Top 50 Most Distinguished Litigation Lawyers in Kenya and the Top Arbitrator in Kenya in 2023.

References

Abe. O., ‘Leveraging Natural Resources for Sustainable Development in Africa.’ Available at https://www.afronomicslaw.org/2019/07/30/leveraging-natural-resources-forsustainable-development-in-africa (Accessed on 09/01/2024).

Africa 50., ‘ESG & Climate.’ Available at https://www.africa50.com/our-company/esgclimate/ (Accessed on 08/01/2023).

Africa Union., ‘Agenda 2063: The Africa We Want.’ Available at https://au.int/sites/default/files/documents/33126-doc-framework_document_book.pdf (Accessed on 09/01/2024).

African Economic Outlook 2023., ‘Mobilizing Private Sector Financing for Climate and Green Growth in Africa.’ Available at https://www.afdb.org/sites/default/files/documents/publications/afdb23- 01_aeo_main_english_0602.pdf (Accessed on 09/01/2024).

African Union., ‘Agreement Establishing the African Continental Free Trade Area.’ Available at https://au.int/sites/default/files/treaties/36437-treatyconsolidated_text_on_cfta_-_en.pdf (Accessed on 09/01/2024).

African Union., ‘The Environmental, Social, and Governance: An African Private Sector Study.’ Available at https://au.int/en/announcements/20230329/environmental-social-and-governance-africanprivate-sector-study (Accessed on 08/01/2023).

Ajibade, L.T & Awomuti, A.A. ‘Petroleum Exploitation or Human Exploitation? An Overview of Niger Delta Oil Producing Communities in Nigeria’ African Research Review Vol. 3 (1), 2009. Pp. 111-124.

Barbosa. A., et al., ‘Integration of Environmental, Social, and Governance (ESG) Criteria: Their Impacts on Corporate Sustainability Performance.’ Humanities & Social Sciences Communications., 2023.

CFA Institute., ‘What is Sustainable Investing?’ Available at https://www.cfainstitute.org/en/rpc-overview/esg-investing/sustainableinvesting (Accessed on 08/01/2024) 14 Harvard Business School., ‘What is Sustainable Investing?’ Available at https://online.hbs.edu/blog/post/sustainable-investing (Accessed on 08/01/2024).

CFI, ESG (Environmental, Social and Governance), Available at: https://corporatefinanceinstitute.com/resources/knowledge/other/esg-environmentalsocialgovernance/ (Accessed on 08/01/2024).

CMS., ‘Putting the ‘S’ in ‘ESG’- a Corporate Guide.’ Available at https://cms.law/en/int/publication/social-aspect-of-esg-lexicon-of-most-important-terms-andphrases (Accessed on 08/01/2023).

Eccles. R., Lee. L-E., & Stroehle. J., ‘The Social Origins of ESG? An Analysis of Innovest and KLD.’ Available at https://www.researchgate.net/profile/JudithStroehle/publication/330732655_The_Social_Origins_of _ESG_An_Analysis_of_Innovest_an d_KLD/links/5c7fc8e9458515831f895ba7/The-Social-Origins-of-ESG-An-Analysis-ofInnovest-and-KLD.pdf (Accessed on 08/01/2024).

ESG., ‘The Link Between ESG and Community Engagement: Building Stronger Relationships.’ Available at https://vakilsearch.com/blog/the-link-between-esg-andcommunity-engagement/ (Accessed on 08/01/2024).

Henisz. W, Koller. T, & Nuttall. R., ‘Five Ways that ESG Creates Value.’ McKinsey Quarterly, 2019.

International Labour Organization., ‘Environmental Social Governance (ESG) and Its Implications for Enterprises in Africa.’ Available at https://www.ilo.org/actemp/regions/africa/WCMS_848401/lang–en/index.htm (Accessed on 09/01/2024).

Li. T., et al., ‘ESG: Research Progress and Future Prospects.’ Available at https://pdfs.semanticscholar.org/0dd4/941ebea33330210daff5f37a1c8cdd0547d7.pd f (Accessed on 08/01/2024).

Makwana, R., ‘Multinational Corporations (MNCs): Beyond the Profit Motive,’ Share the World Resources, 3rd October 2006, available at http://www.stwr.org/multinationalcorporations/multinational-corporations-mncs-beyondtheprofitmotive.html#legalrights (Accessed on 09/01/2024).

Muigua. K., ‘Embracing Environmental, Social and Governance (ESG) Principles for Sustainable Development in Kenya.’ Available at http://kmco.co.ke/wpcontent/uploads/2022/07/EmbracingESG-Principles-for-Sustainable-Development-inKenya.pdf (Accessed on 08/01/2024).

Muigua. K., ‘Multinational Corporations, Investment and Natural Resource Management in Kenya.’ Available at https://kmco.co.ke/wpcontent/uploads/2018/11/Multinational-Corporations-Investment-and-Natural-ResourceManagement-in-Kenya-Kariuki-Muigua-November-2018.pdf (Accessed on 08/01/2024).

Muigua. K., ‘Rule of Law Approach for Inclusive Participation in Environmental, Social, and Governance (ESG) Accountability Mechanisms for Climate-Resilient Responses.’ Available at https://kmco.co.ke/wp-content/uploads/2024/01/Rule-of-LawApproach-for-Inclusive-Participation-in-Environmental-Social-and-Governance-ESGAccountability-Mechanisms-for-Climate-Resilient-Responses.pdf (Accessed on 08/01/2024).

Nunekpeku. R., ‘ESG Inroads and Sustainable Investments in Africa: Promoting Compliance by Private Companies.’ Available at https://thebftonline.com/2023/04/11/esg-inroads-and-sustainable-investments-inafrica-promoting-compliance-by-private-companies/?amp= (Accessed on 09/01/2024).

Organisation for Economic Co-Operation and Development., ‘Africa’s Sustainable Investments in Times of Global Crises.’ Available at https://www.oecdilibrary.org/sites/32dddc3a-en/index.html?itemId=/content/component/32dddc3a-en (Accessed on 08/01/2024).

Organisation for Economic Co-Operation and Development., ‘Environmental Social and Governance (ESG) Investing’ Available at https://www.oecd.org/finance/esginvesting.htm (Accessed on 08/01/2024).

Peterdy. K., & Miller. N., ‘ESG (Environmental, Social, & Governance).’ Available at https://corporatefinanceinstitute.com/resources/esg/esg-environmental-social-governance/ (Accessed on 08/01/2023).

Premji. Z., ‘Sustainable Investing: Unlocking Africa’s Potential.’ Available at https://www.bscapitalmarkets.com/sustainable-investing-unlocking-africarsquospotential.html (Accessed on 08/01/2024).

PwC Kenya., ‘Taking Action on your ESG Strategy – Africa.’ Available at https://www.pwc.com/ke/en/publications/taking-action-on-your-esg-strategy.html (Accessed on 08/01/2023).

Sriyani. C. & Heenetigala. K., ‘Integrating Environmental, Social and Governance (ESG) Disclosure for a Sustainable Development: An Australian Study.’ Business Strategy and the Environment, No. 26 of 2017.

Stuart. L.G et al., ‘Firms and Social Responsibility: A Review of ESG and CSR Research in Corporate Finance.’ Journal of Corporate Finance 66 (2021): 101889.

The World Bank., ‘The World Bank in Africa.’ Available at https://www.worldbank.org/en/region/afr/overview (Accessed on 08/01/2024).

United Nations Economic Commission for Africa., ‘Africa Should Leverage the AfCFTA to Promote Green Transition.’ Available at https://www.uneca.org/stories/africa-should-leverage-the-afcfta-to-promote-green-transition (Accessed on 09/01/2024).

United Nations Environment Programme., ‘Is Africa’s Natural Capital the Gateway to Finance Its Development?’ Available at https://www.unep.org/news-andstories/story/africas-natural-capital-gateway-finance-its-development (Accessed on 09/01/2024).

United Nations., ‘Africa’s Free Trade on Track, More Efforts Needed.’ Available at https://www.un.org/africarenewal/magazine/january-2023/africa%E2%80%99s-free-tradetrack-moreefforts-needed#:~:text=lies%20ahead%2C%20though.- ,Presently%2C%20intra%20Africa%20trade%20stands%20low%20at%20just%2014.4%2 5%20of,day)%2C% 20according%20to%20UNCTAD (Accessed on 09/01/2024).

Van Duuren. E., Plantinga. A., & Scholtens. B., ‘. ESG Integration and the Investment Management Process: Fundamental Investing Reinvented.’ Journal of Business Ethics, 138(3), 525-533.

Wadhwani. H., ‘Charting the ESG Landscape in Africa: Sustainable Opportunities and Challenges.’ Available at https://www.linkedin.com/pulse/charting-esg-landscapeafrica-sustainable-challenges-wadhwani/ (Accessed on 09/01/2023).

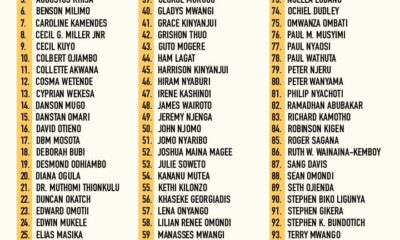

Lawyers1 year ago

Lawyers1 year ago

News & Analysis3 years ago

News & Analysis3 years ago

News & Analysis3 years ago

News & Analysis3 years ago

Lawyers1 year ago

Lawyers1 year ago

News & Analysis2 years ago

News & Analysis2 years ago

News & Analysis1 year ago

News & Analysis1 year ago

News & Analysis3 years ago

News & Analysis3 years ago

News & Analysis1 year ago

News & Analysis1 year ago