By Hon. Prof. Kariuki Muigua, OGW, PhD, C.Arb, FCIArb is a Professor of Environmental Law and Dispute Resolution at the University of Nairobi, Member of Permanent Court of Arbitration, Leading Environmental Law Scholar, Respected Sustainable Development Policy Advisor, Top Natural Resources Lawyer, Highly-Regarded Dispute Resolution Expert and Awardee of the Order of Grand Warrior (OGW) of Kenya by H.E. the President of Republic of Kenya. He is The African ADR Practitioner of the Year 2022, The African Arbitrator of the Year 2022, ADR Practitioner of the Year in Kenya 2021, CIArb (Kenya) Lifetime Achievement Award 2021 and ADR Publisher of the Year 2021 and Author of the Kenya’s First ESG Book: Embracing Environmental Social and Governance (ESG) tenets for Sustainable Development” (Glenwood, Nairobi, July 2023) and Kenya’s First Two Climate Change Law Book: Combating Climate Change for Sustainability (Glenwood, Nairobi, October 2023), Achieving Climate Justice for Development (Glenwood, Nairobi, October 2023) and Promoting Rule of Law for Sustainable Development (Glenwood, Nairobi, January 2024)*

The growth of carbon markets has resulted in multiplicity of disputes in the area. For example, disputes in carbon markets can arise because of non-compliance of rules for carbon market cooperation and greenhouse gas emissions by developed nations. Further, it has been contended that the integrity of carbon markets depends in large part on the reliability of carbon accounting and this requires information about an entity’s emissions and offsets to be genuine, precise and accurate. However, there are several challenges that make carbon accounting a difficult exercise, which contributes to increased risk of disputes.

It has been noted that such challenges include the lack of a credible and consistent method of calculating both emissions produced by a business, and emissions avoided or stored by an abatement project; the lack of a standardised emissions data collection procedure across entities and sectors, which is often done manually and is error-prone; inconsistencies in defining the scope of carbon accounting for example whether and how much upstream and downstream supply chain emissions are included; and the complex and heterogenous taxonomy of carbon accounting where the terminology commonly used to describe emissions and offsets lacks a universally recognised set of definitions.

It has been contended that the lack of clarity in carbon accounting practices is ripe for disputes. Carbon accounting practices lack a universally accepted standard, leading to a fragmented landscape of methodologies and reporting frameworks. This lack of clarity may lead to exposure to claims of greenwashing, misleading or deceptive conduct and, contractual disputes regarding the proper value and/or veracity of carbon allowances and carbon offsets. It has been noted that the absence of credible standardization creates confusion, making it challenging to compare emissions data between organizations or across industries.

Additionally, it increases the risk of greenwashing, where organizations may engage in misleading or exaggerated claims about their environmental performance. Such actions could result in disputes in carbon markets. It has also been noted that carbon markets are associated with certain risks which could potentially result in disputes.

These risks include the integrity risk which refers to possibilities that investors are influenced by misleading information when buying and selling carbon products, which also occur when companies abandon honest and credible trading strategies under imperfect regulation; the vulnerability risk which means incomplete infrastructures and imperfect systems, which make carbon markets susceptible to internal and external shocks; market abuse risk where dominant or influential institutions engage in practices such as insider trading, price manipulation, and other unethical practices; and liquidity risk which reflects certain factors including the number of carbon products and marketization degree that affect confidences of market participants.

It has been asserted that some of these risks are already being transmitted to participants, including compliance entities, institutions, and individuals creating the likelihood of disputes in carbon markets. In addition, it has been opined that while the growth in carbon markets and market participants generates opportunities for much needed emissions reductions, it also requires participants to navigate regulatory and political risks. For example, a participant seeking to take advantage of cross-border trading opportunities may be subject to regulatory action by multiple states as well as inter-state bodies.

It has been observed that some governments have decided to cancel emissions markets without notice following a change in administration, while others have limited the use of certain types of compliance units in their jurisdiction, or taken other measures that affect the value of compliance units, potentially with the aim of enhancing environmental integrity. Such actions by states could result in disputes with investors trading in carbon markets since they transform what was once a freely tradable commodity into a stranded asset.

From the foregoing, it is evident that carbon markets are susceptible to disputes. It has been pointed out that carbon disputes often turn on issues common to other contractual disputes. These issues include commodity non-delivery, breach of covenants or warranties, failure to fulfil conditions precedent, disputes over title or security among others. Further, it has been pointed out that distinctive elements of such disputes include the nature of the commodity, the carbon crediting project cycle, and the application of international climate standards.

In addition, the project cycle itself can also generate disputes such as those concerning project registration or credit issuance. It has also been noted that carbon disputes are not limited to carbon contracts themselves but extend to the full scope of disputes concerning the underlying infrastructure projects undertaken to generate emission reductions, potentially resulting in commercial or investment arbitration proceedings.

Disputes are undesirable in carbon markets and can hinder the effective functioning of carbon markets and slow down the progress towards confronting climate change. It has been argued that carbon markets can be a powerful tool to help advance carbon justice. By entering carbon markets, all countries can advance their socioeconomic development while transitioning to a low-carbon economy in a cost-effective way that puts a price on carbon, allows for carbon trading, and stimulates new market opportunities for companies. It is therefore necessary to effectively manage disputes in carbon markets in order to strengthen the global response towards climate change and foster Sustainable Development.

*This is an extract from the Article: Managing Disputes in Carbon Markets, Available at: https://kmco.co.ke/wp-content/uploads/2024/02/Managing-Disputes-in-Carbon-Markets.pdf (25th February 2024) by Hon. Prof. Kariuki Muigua, OGW, PhD, Professor of Environmental Law and Dispute Resolution, Senior Advocate of Kenya, Chartered Arbitrator, Kenya’s ADR Practitioner of the Year 2021 (Nairobi Legal Awards), ADR Lifetime Achievement Award 2021 (CIArb Kenya), African Arbitrator of the Year 2022, Africa ADR Practitioner of the Year 2022, Member of National Environment Tribunal (NET) Emeritus (2017 to 2023) and Member of Permanent Court of Arbitration nominated by Republic of Kenya. Prof. Kariuki Muigua is a foremost Environmental Law and Natural Resources Lawyer and Scholar, Sustainable Development Advocate and Conflict Management Expert in Kenya. Prof. Kariuki Muigua teaches Environmental Law and Dispute resolution at the University of Nairobi School of Law, The Center for Advanced Studies in Environmental Law and Policy (CASELAP) and Wangari Maathai Institute for Peace and Environmental Studies. He has published numerous books and articles on Environmental Law, Environmental Justice Conflict Management, Alternative Dispute Resolution and Sustainable Development. Prof. Muigua is also a Chartered Arbitrator, an Accredited Mediator, the Managing Partner of Kariuki Muigua & Co. Advocates and Africa Trustee Emeritus of the Chartered Institute of Arbitrators 2019-2022. Prof. Muigua is a 2023 recipient of President of the Republic of Kenya Order of Grand Warrior (OGW) Award for his service to the Nation as a Distinguished Expert, Academic and Scholar in Dispute Resolution and recognized among the top 5 leading lawyers and dispute resolution experts in Band 1 in Kenya by the Chambers Global Guide 2024 and was listed in the Inaugural THE LAWYER AFRICA Litigation Hall of Fame 2023 as one of the Top 50 Most Distinguished Litigation Lawyers in Kenya and the Top Arbitrator in Kenya in 2023.

References

Chen. B., Yuan. K., & Wen. X., ‘The Legal Governance of the Carbon Market: Challenges and Application of Private Law in China’ Available at https://www.tandfonline.com/doi/full/10.1080/17583004.2023.2288591 (Accessed on 22/02/2024).

Climate Change (Amendment) Act, 2023., Laws of Kenya, Government Printer, Nairobi.

Climate Change (Amendment) Act, 2023., Laws of Kenya, S 2, Government Printer, Nairobi.

Darne. A., ‘International Carbon Disputes – How can they be resolved through Arbitration?’ Available at https://www.pslchambers.com/article/international-carbon-disputes-how-can-they-be-resolvedthrough arbitration/#:~:text=Arbitration%20has%20played%20a%20vital,issues%20be%20resolved%20through% 20ADR (Accessed on 22/02/2024).

Environmental Management and Co-ordination Act, No. 8 of 1999, Laws of Kenya, Government Printer, Nairobi.

ESG Investor., ‘Greater Scope for Carbon Markets Legal Action in Asia’ Available at https://www.esginvestor.net/greater-scope-for-carbon-markets-legal-action-in-asia/ (Accessed on 23/02/2024).

ESG., ‘Understanding the Challenges and Risks of Carbon Accounting: Implications for Organizations’ Available at https://empoweredsystems.com/blog/understanding-the-challenges-and-risks-of-carbon accounting-implications-fororganizations/#:~:text=Carbon%20accounting%20practices%20lack%20a,bet ween%20organizations%20o r%20across%20industries. (Accessed on 22/02/2024).

Green Arbitrations., ‘Emissions Trading: What Role will Arbitration Play?’ Available at https://www.greenerarbitrations.com/news/emissions-trading-what-role-will-arbitration-play (Accessed on 22/02/2024).

International Emissions Trading Association., ‘European Union Emissions Trading Scheme (EU ETS)’ Available at https://ieta.b-cdn.net/wpcontent/uploads/2023/09/IETA_TradingDocuments_ETMA_Sched 23A3B_v4.0.pdf (Accessed on 23/02/2024).

Kwan. E., Nagra. S., Zou. A., ‘Dispute Resolution in Carbon Markets’ Available at https://arbitrationblog.kluwerarbitration.com/2023/09/16/dispute-resolution-in-carbon-markets/ (Accessed on 22/02/2024).

Minas. S., ‘COP26 Created New Carbon Market Rules: How Will Arbitration Respond?’ Available at https://arbitrationblog.kluwerarbitration.com/2022/01/23/cop26-created-new-carbon-market-ruleshow-will-arbitration-respond/ (Accessed on 22/02/2024).

Moses, ‘The Principles and Practice of International Commercial Arbitration’ 2nd Edition, 2017, Cambridge University Press.

Muigua. K., ‘Alternative Dispute Resolution and Access to Justice in Kenya’ Glenwood Publishers Limited, 2015.

Muigua. K., ‘Promoting International Commercial Arbitration in Africa.’ Available at http://kmco.co.ke/wpcontent/uploads/2018/08/PROMOTINGINTERNATIONALCOMMERCIALARBITRATION-INAFRICA.pdf (Accessed on 23/02/2024).

Muigua. K., ‘Settling Disputes through Arbitration in Kenya.’ Glenwood Publishers, 4th Edition, 2022.

Natural Justice., ‘Kenya’s Climate Change Bill: Paving the Way for Sustainable Development and Carbon Markets.’ Available at https://naturaljustice.org/kenyas-climate-change-bill-paving-the-wayforsustainable-development-and-carbon-markets/ (Accessed on 22/02/2024).

Sustainable Energy for All., ‘Africa Carbon Markets Initiative (ACMI).’ Available at https://www.seforall.org/our-work/initiatives-projects/ACMI (Accessed on 22/02/2024).

The International Organization of Securities Commissions., ‘Compliance Carbon Markets’ Available at https://www.iosco.org/library/pubdocs/pdf/IOSCOPD719.pdf (Accessed on 23/02/2024).

The Norwegian Ministry of Climate and Environment., ‘Certified Emission Reduction Purchase Agreement’ Available at https://www.regjeringen.no/contentassets/86680864084e47118f0086fccc0855 fd/template-nmoce-erpa2016-2020.pdf (Accessed on 23/02/2024).

United Nations Climate Change., ‘Emissions Trading’ Available at https://unfccc.int/process/the-kyotoprotocol/mechanisms/emissions-trading (Accessed on 22/02/2024).

United Nations Commission on International Trade Law., ‘Convention on the Recognition and Enforcement of Foreign Arbitral Awards.’ (New York, 1958).

United Nations Department of Political and Peacebuilding Affairs., ‘The Implications of Climate Change for Mediation and Peace Processes’ Available at https://peacemaker.un.org/sites/peacemaker.un.org/files/DPPAPracticeNoteTheImplicationsofClimateChangeforMediationandPeaceProcesses.pdf (Accessed on 23/02/2024).

United Nations Development Programme., ‘Carbon Justice for All: How Carbon Markets Can Advance Equitable Climate Action Globally’ Available at https://www.undp.org/africa/blog/carbon-justice-allhow-carbon-markets-can-advance-equitable-climate-action-globally (Accessed on 23/02/2024).

United Nations Development Programme., ‘What are Carbon Markets and Why are They Important?’ Available at https://climatepromise.undp.org/news-and-stories/what-are-carbon-markets-and-why-arethey-important (Accessed on 22/02/2024).

United Nations Framework Convention on Climate Change., ‘Kyoto Protocol to the United Nations Framework Convention on Climate Change.’ Available at https://unfccc.int/resource/docs/convkp/kpeng.pdf (Accessed on 22/02/2024).

United Nations Framework Convention on Climate Change., ‘Paris Agreement.’ Available at https://unfccc.int/sites/default/files/english_paris_agreement.pdf (Accessed on 22/02/2024).

United Nations Framework Convention on Climate Change., United Nations, 1992., Available at https://unfccc.int/resource/docs/convkp/conveng.pdf (Accessed on 23/02/2024).

United Nations., ‘Carbon Offset Platform’ Available at https://offset.climateneutralnow.org/ (Accessed on 22/02/2024).

UN-REDD Programme., ‘Carbon Market’ Available at https://www.un-redd.org/glossary/carbonmarket (Accessed on 22/02/2024).

World Bank., ‘General Conditions Applicable to Emission Reductions Payment Agreements for Forest Carbon Partnership Facility Emission Reductions Programs’ Available at https://www.forestcarbonpartnership.org/sites/fcp/files/2019/Sep/6.%20Emission%20Reductions%20 Payment%20Agreement%20%28ERPA%29%20General%20Terms%20and%20Conditions%20%28English %29.pdf (Accessed on 23/02/2024).

World Intellectual Property Organization., ‘What is Arbitration’ Available at https://www.wipo.int/amc/en/arbitration/what-is-arb.html (Accessed on 23/02/2024).

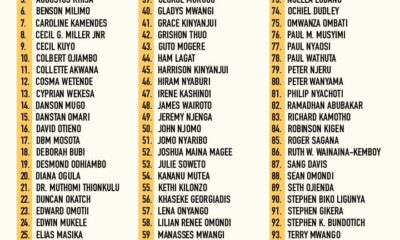

Lawyers1 year ago

Lawyers1 year ago

News & Analysis3 years ago

News & Analysis3 years ago

News & Analysis3 years ago

News & Analysis3 years ago

Lawyers1 year ago

Lawyers1 year ago

News & Analysis2 years ago

News & Analysis2 years ago

News & Analysis1 year ago

News & Analysis1 year ago

News & Analysis3 years ago

News & Analysis3 years ago

News & Analysis1 year ago

News & Analysis1 year ago