Law Firms

KN Law LLP Becomes Kenya’s First Law Firm to Set-up a London Office

Mugambi Nandi was ranked in the 2021 Edition of Chambers Global Guide as one of the top Kenyan Corporate/M&A experts based abroad. Mugambi has been in London since 2019, when KN Law LLP set up its London Office at Berkeley Suite, 35 Berkeley Square, Mayfair, London, W1J 5BF.

Law Firms

Understanding the Legacy of Wealth: Intro to Transgenerational Estate Planning

MNO Advocates LLP is a trusted boutique law firm delivering legal services tailored to the challenges and opportunities of the modern business environment. The firm are recognized leaders in Transgenerational Estate Planning, Commercial & Corporate, Immigration, Legal Audit & Compliance, Dispute Resolution, and Employment law. We help clients navigate legal complexities with confidence both regionally and internationally.

Founded by three lawyer friends who were passionate about their craft but frustrated by the legal landscape for Small and Medium-size Enterprises (SMEs), MNO Advocates LLP set out to address the challenges of navigating complex legalese, hefty fees from traditional firms, and lack of personalized attention. Ignited by a shared dream, the three founders built a different kind of law firm - one focused on relationships, providing affordable and creative legal solutions, and showing relentless dedication to helping SMEs thrive.

MNO advocates' expertise has continued to grow alongside their client base. They have sharpened their skills in areas critical to SMEs, including contract review, intellectual property protection, employment law, and dispute resolution. They have become champions for their clients, fiercely advocating for their rights and ensuring their legal needs are met efficiently and effectively.

Today, MNO Advocates LLP is a thriving force in the legal community. They have expanded their team with talented advocates who share their passion for helping SMEs and also leveraged technology to streamline processes and offer cost-effective services. We have set ourselves apart as the go-to law firm for clients in the creative industry as well as fintech companies.

Looking ahead, MNO Advocates LLP is committed to continuous growth and innovation. We stay at the forefront of legal issues affecting SMEs, adapting how we serve the constantly changing landscape. Our story is a testament to the power of fostering relationships.

Law Firms

The Unfolding Scenario of Digital Lending Regulation in Kenya

MMW Advocates LLP is one of Kenya’s largest female-led law firms with a focus on positively impacting the commercial ecosystem with out-of-the-box solutions.

MMW Advocates was birthed from a different breed. A breed that believes that the law should not be rigid and uncompromising. Instead, it should be a tool for commercial solutions. For this reason, the firm’s rallying call is – Think Differently-Solve Innovatively.

It is no wonder that it has cultivated trust from Multi-National Corporations and the Public Sector with bold footprints in Africa, Asia, Europe, and North America.

MMW Advocates continuously sets the pace for emerging commercial laws and jurisprudence and is an ideal partner for any entity that is keen on being a part of Africa’s commercial development story.

Law Firms

A Toolkit for Customers on accessing Financial Services in Kenya

HMS Africa Advocates LLP is considered the foremost innovative and full-service Law Firm in Kenya. Our Clients navigate and transact in diverse sectors with new and evolving opportunities. Our services to our Clients extend across the globe with a presence in Kenya, Tanzania, Uganda, Ghana and Egypt. In a constantly changing environment, we apply a bespoke approach to resolving the legal challenges posed across industries and jurisdictions ensuring the best possible results for our clients.

Our Firm was founded in 2016 by leading independent Legal minds and industry professionals who are united by a shared vision and dedicated to achieving excellence legal practice. We nurture a forward thinking mindset, collaboration and corporate responsibility and are committed to creating a better future for our clients and the communities around us.

We are achieving our Firm’s vision through an inclusive outlook which guarantees tailor made solutions for our valued Client’s and our team has developed expertise in the following areas: Banking, Financial Services & Insolvency, Corporate and Commercial Law, Employment and Labour Relations Law, Tax Law, Real Estate and Construction Law, Immigration, Litigation & Dispute Resolution, Intellectual Property and

Technology, Media and Telecommunications (TMT).

-

Lawyers1 year ago

Lawyers1 year agoTHE LAWYER AFRICA Litigation Hall of Fame | Kenya in 2023

-

News & Analysis3 years ago

News & Analysis3 years agoThe Definition, Aspects and Theories of Development

-

News & Analysis3 years ago

News & Analysis3 years agoThe Definition and Scope of Biodiversity

-

Lawyers1 year ago

Lawyers1 year agoTHE LAWYER AFRICA Top 100 Litigation Lawyers in Kenya 2023

-

News & Analysis2 years ago

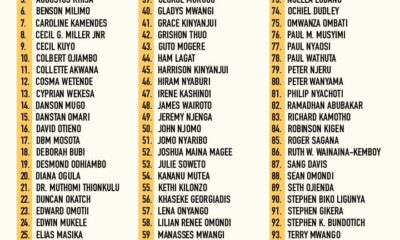

News & Analysis2 years agoTHE TOP 200 ARBITRATORS IN KENYA 2022

-

News & Analysis1 year ago

News & Analysis1 year agoThe Role of NEMA in Pollution Control in Kenya

-

News & Analysis3 years ago

News & Analysis3 years agoRole of Science and Technology in Environmental Management in Kenya

-

News & Analysis1 year ago

News & Analysis1 year agoHow to Become an Arbitrator in Kenya